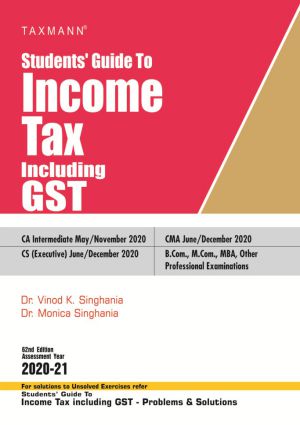

CA Final Direct Taxes Law and Practice For May 2020 Exams By Vinod K Singhania , Kapil Singhania

With special reference to Tax Planning This Book is useful for CA Final students old and New Syllabus Appearing in May 2020 Exam and onward.

₹1,725

₹1,540

Safe and Secure Payments. Easy returns. 100% Authentic products.

Safe and Secure Payments. Easy returns. 100% Authentic products.

|

HAVE QUERIES? GET QUICK HELP

CHECK CASH ON DELIVERY AND NEXT DAY DELIVERY AT YOUR LOCATION:

- Cash on Delivery

- Next Day Delivery

Customers who bought this item also bought:

General Information:

-

Author: Vinod K Singhania

-

Publication: Taxmann

-

Cover: Paperback

-

Language: English

-

ISBN Number: 9789389546835

-

Number of Pages: 1712

-

Edition: 63rd Edition (Assessment Year 2020-21)

-

Useful For: CA Final

For CA (Final) May/November 2020,

CS(Professional) June/December 2020,

CMA (Final)June/December 2020,

M.Com/MBA/LL.B and other specialised examinations for academic year 2020-21

Contents -

Basic concepts,

Residential status and tax incidence,

Incomes exempt from tax,

Salaries,

Income from house property ,

Profits and gains of business or profession,

Capital gains,

Income from other sources,

Income of other persons included in assessee?s total income,

Set off and carry forward of losses,

Deductions from gross total income and tax liability,

Agricultural income,

Typical problems on assessment of individuals,

Tax treatment of Hindu undivided families,

Special provisions governing assessment of firms and association of persons,

Taxation of companies,

Assessment of co-operative societies,

Assessment of charitable and other trusts,

Return of income and assessment,

Penalties and prosecutions,

Advance payment of tax,

Interest,

Tax deduction or collection at source,

Refund of excess payments,

Appeals and revisions,

Income-tax authorities,

Settlement of cases,

Special measures in respect of transactions with persons located in notified jurisdictional area,

General Anti-Avoidance Rule,

Advance ruling for non-residents,

Search, seizure and block assessment,

Transfer pricing,

Business restructuring,

Tax planning,

Miscellaneous.

About the Author:-

Dr. Vinod K. Singhania got his Ph.D. from the Delhi School of Economics in 1976. His fields of special interest include all facets of corporate legislation and corporate economics especially the tax laws. Associated in different capacities with several professional institutes and business houses in India and abroad, Dr. Singhania is author of many popular books and software published by Taxmann. He has to his credit more than 300 research articles which have appeared in leading journals. He has been a resource person in over 400 seminars in India and abroad. He can be reached at vks@taxmann.com.

Dr. Kapil Singhania, a Fellow of the Institute of Chartered Accountants of India and belonging to the alumni of Shri Ram College of Commerce, has completed his research work for which he has been awarded Ph.D. in 2003. His fields of involvement in research work in form of articles in various reputed journals and analytical studies span across from corporate laws to direct and indirect taxation. He has authored a variety of acclaimed books on direct and indirect taxes published by Taxmann. Dr. Singhania is providing tax consultancy to a number of business organizations, which include multinational and public sector companies.