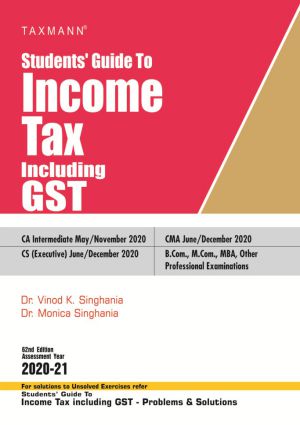

CA Inter/ CA IPCC Students Guide to Income Tax Including GST Old and New Syllabus For May 2020 By Vinod K Singhania , Monica Singhania

This Book is useful for CA IPC students Old and New Syllabus Appearing in May 2020 Exam

Safe and Secure Payments. Easy returns. 100% Authentic products.

Safe and Secure Payments. Easy returns. 100% Authentic products.

|

- Cash on Delivery

- Next Day Delivery

-

Author: Vinod K Singhania

-

Publication: Taxmann

-

Cover: Paperback

-

Language: English

-

ISBN Number: 9789389546453

-

Number of Pages: 984

-

Edition: 62nd Edition 2020-21

-

Useful For: CA IPC/ Inter students

CA Intermediate May / November 2020

CS (Executive) June / December 2020

CMA June / December 2020

B.Com., M.Com.,MBA, Other Professional Examinations

Contents -

Part – A Income Tax -

Basic Concepts that One Must Know

Residential Status And Its Effect on Tax Incidence.

Income Tax is Exempt From Tax.

Income Under The Head ” Salaries” And Its Computation.

Income under The Head “Income From House property”.

Income under The Head “Profits and Gains Of business OR Profession and It’s Computation”.

Income under The Head “Capital Gains” And Its Computation.

Income under The Head “Income From Other Sources”and It’s Computation.

Clubbing Of Income.

Set Off And Carried Forword Of Losses.

permissible Dedunction From Gross total Income.

MeaningOf Agricultural Income and Its Tax Treatment.

Individual- Computation Of Taxable Income..

Hindu Undivided Families.

Firms and AOP.

Return Of Income.

Advance Payment Of Tax.

Tax Dedunction and Collection At Source.

Interest Payable.

Part – B

GST