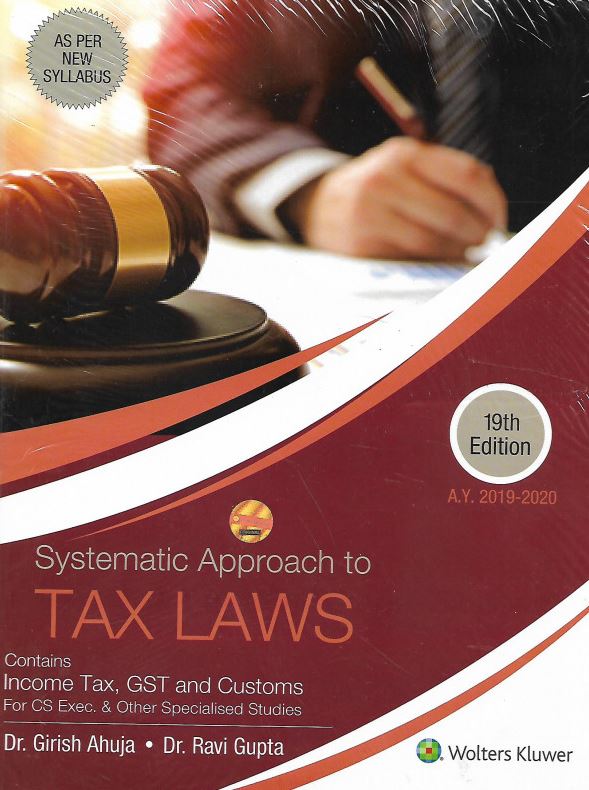

Cs Executive Systematic Approach to Tax Laws and Practice For Dec. 2019 By Girish Ahuja & Ravi Gupta

This Book is useful for cs Executive New Syllabus students Appearing in Dec. 2019 Exam and onward .

₹1,449

₹1,275

Safe and Secure Payments. Easy returns. 100% Authentic products.

Safe and Secure Payments. Easy returns. 100% Authentic products.

|

HAVE QUERIES? GET QUICK HELP

CHECK CASH ON DELIVERY AND NEXT DAY DELIVERY AT YOUR LOCATION:

- Cash on Delivery

- Next Day Delivery

Customers who bought this item also bought:

General Information:

-

Author: Dr. Girish Ahuja

-

Publication: Wolters Kluwer

-

Cover: Paperback

-

Language: English

-

ISBN Number: 9789388696968

-

Number of Pages: 1073

-

Edition: 19th, 2019

-

Useful For: Cs Executive students

Contents

Part A — Income Tax

Chapter-1 Introduction

Chapter-2 Scope of Total Income & Residential Status (Sections 5 to 9)

Chapter-3 Incomes which do not form part of Total Income (Sections 10, 10AA and 11 to 13A)

Chapter 4 Computation of Total Income and Income Under the Head Salaries

Chapter-5 Income under the Head "Income from House Property" (Sections 22 to 27)

Chapter-6 Income under the Head "Profits and Gains of Business or Profession" (Sections 28 to 44D)

Chapter-7 Income under the Head "Capital Gains" (Sections 45 to 55A)

Chapter-8 Income under the Head "Income from Other Sources" (Sections 56 to 59)

Chapter-9 Income of Other Persons Included in Assessee's Total Income (Clubbing of Income) (Sections 60 to 65)

Chapter-10 Set off or Carry Forward and Set off of Losses (Sections 70 to 80)

Chapter-11 Deductions to be made in Computing Total Income [Sections 80A to 80U (Chapter VIA)]

Chapter-12 Agricultural Income & Its Tax Treatment [Sections 2(1A) and 10(1)]

Chapter-13 Assessment of Individuals

Chapter 14 Assessment of Hindu Undivided Family

Chapter-15 Assessment of Firms

Chapter 16 Assessment of Association of Persons

Chapter-17 Assessment of Co-operative Societies

Chapter 18 Assessment of Companies

Chapter-19 Taxation of Non-Residents [Chapter XII and XIIA of the Income-tax Act]

Chapter-20 Deduction of Tax at Source [Sections 190 to 206CA]

Chapter-21 Advance Payment of Tax [Sections 207-211, 217 & 219]

Chapter-22 Return of Income and Procedure of Assessment [Sections 139 to 154]

Chapter-23 Liability in Special Cases [Chapter XV, Sections 159 to 179]

Chapter-24 Collection and Recovery of Tax [Sections 156, 220 to 232]

Chapter-25 Refunds [Sections 237 to 241]

Chapter-26 Appeals and Revision [Sections 246 to 264]

Chapter-27 Settlement of cases [Sections 245A to 245L]

Chapter-28 Penalties and Prosecutions

Chapter-29 Tax Planning and Tax Management

Part II International Taxation (Relevant Only Under New Syllabus)

Chapter-1 Basic concepts of International Taxation

Chapter-2 Double Taxation Relief [Sections 90 to 91]

Chapter-3 Transfer Pricing Provisions( Sections 92 to 92F)

Chapter-4 Advance Pricing Agreements

Chapter-5 Advance Rulings

Part III

GST

Chapter 1 Basic Concepts of Indirect Taxes and Introduction of GST

Chapter 2 Supply under GST

Chapter 3 Levy and Collection

Chapter 4 Exemption from GST

Chapter 5 Taxability of Composite and Mixed Supply

Chapter 6 Location of the Supplier and Place of Supply of Goods and Services

Cahtper 7 Composition Levy

Chapter 8 Time of Supply

Chatper 9 Value of Supply

Chapter 10 Input Tax Credit and its Utlisation

Chapter 11 Tax Invoice, Credit and Debit Notes

Chapter 12 Registration

Chapter 13 Payment of Tax

Chapter 14 Returns

CHAPTER 15 Accounts and Records under GST

Chapter 15 Assessment and audit

Chapter 17 Anti Profiteering Measure

About the Authors -

Dr. GIRISH AHUJA did his graduation and post-graduation from Shri Ram College of Commerce, Delhi and was a position holder. He was awarded a Ph.D. degree by Faculty of Management Studies (FMS), Delhi University. He has been teaching Direct Taxes to students at various levels for more than 35 years. He is a Fellow of the Institute of Chartered Accountant of India (ICAI) and was a rank holder of both Intermediate and Final examinations of the Institute. He was a senior faculty member of Shriram College of Commerce (Delhi University) and also has been visiting faculty member of the Institute of Chartered Accountants of India (ICAI), Institute of Company Secretaries of India (ICSI) and various management institutes. He had been nominated by the Government to the Central Council of the Institute of Company Secretaries of India for two terms. He is a Special Invitee to the Fiscal Law Committee of ICAI and Editorial Board of ICSI. He is also on the Board of Directors of many reputed companies and has a vast and rich experience in the field of Finance and Taxation. He has also been appointed by the Govt. of India to the Central Board of Director of State Bank of India.

Dr. Ahuja has addressed more than 4000 seminars organized by the ICAI, ICSI, ICWAI, Chambers of Commerce.

Dr. RAVI GUPTA did his graduation and post-graduation from Shri Ram College of Commerce. Thereafter, he did LL.B. from Delhi University and MBA (Finance) from Faculty of Management Studies, Delhi. He has been awarded a Ph.D. degree in International Finance by the Delhi University. He is a faculty member at Shri Ram College of Commerce (Delhi University) and also has vast practical experience in handling tax matters of trade and industry. He has been a visiting faculty member at The Indian Law Institute, The Institute of Company Secretaries of India, MFC (South Campus, Delhi University), MDI and various other Management Institutes. He has addressed more than 2000 seminars on Direct Taxes organized by ICAI, Chambers of Commerce, Universities, etc. He has been appointed by the Government of India as a member of the Committee constituted for Simplification of Income Tax Act. He is an independent director of many reputed companies. He has also been nominated Central council member of the Institute of Chartered Accountants of India by the govt. of India