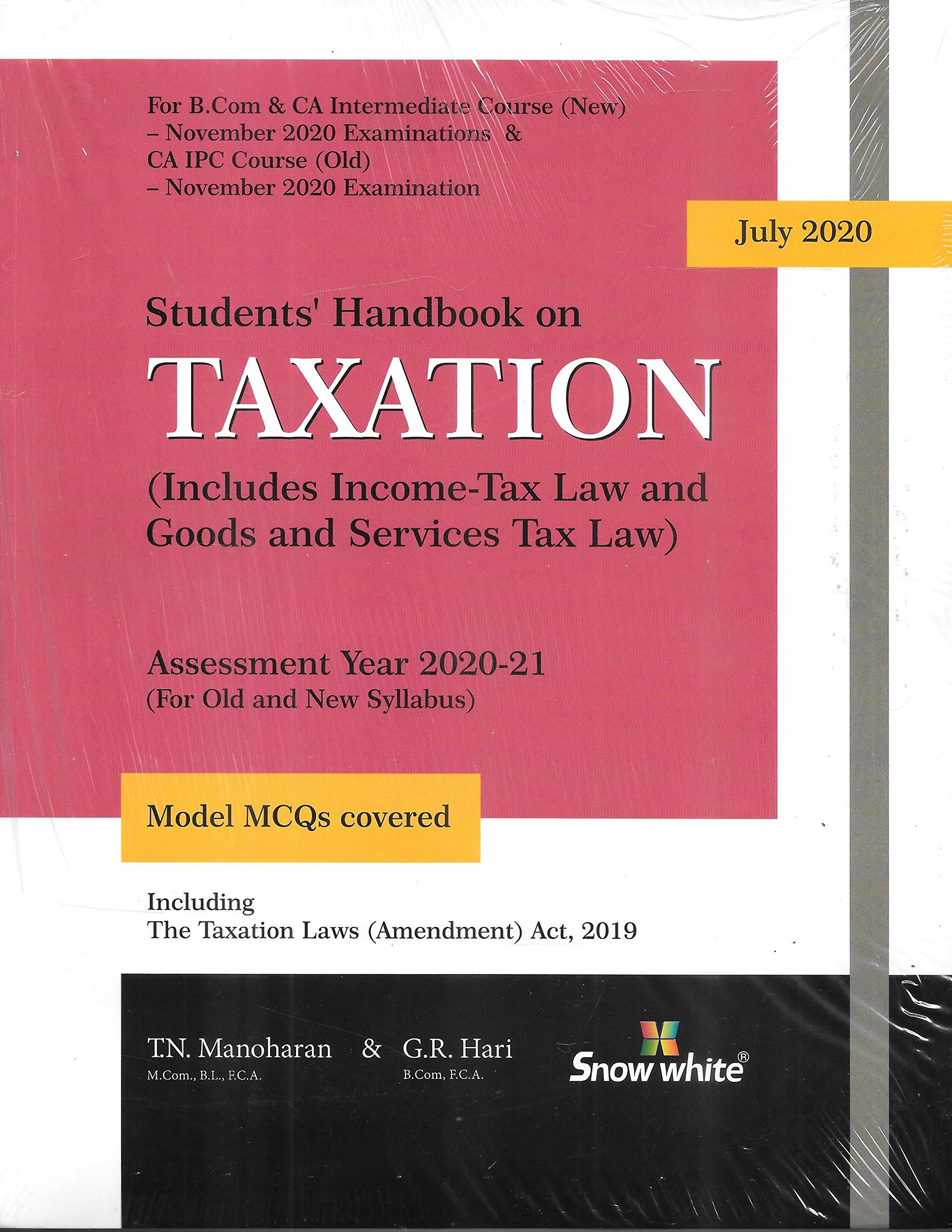

CA inter Taxation By TN Manoharan & G R Hari for Nov. 2020

This Book is useful for CA Inter Old and New Syllabus students Appearing in May 2020 Exams

₹1,195

₹1,040

Safe and Secure Payments. Easy returns. 100% Authentic products.

Safe and Secure Payments. Easy returns. 100% Authentic products.

|

HAVE QUERIES? GET QUICK HELP

CHECK CASH ON DELIVERY AND NEXT DAY DELIVERY AT YOUR LOCATION:

- Cash on Delivery

- Next Day Delivery

Customers who bought this item also bought:

General Information:

-

Author: T N Manoharan, G R Hari

-

Publication: Snow White

-

Cover: Paperback

-

Language: English

-

Study Material Format: Printed Books

-

ISBN Number: 9789350393680

-

Edition: 2020

-

Useful For: CA Inter Old and New Syllabus

Concise presentation of the provisions of the Income-tax Law as amended by the Finance Act (No.2), 2019 relevant for CA Intermediate Course (New) and CA (Integrated Professional Competence) Course (Old) and B.Com Examination Updated rules, important circulars, notifications and case law as reported up to October 2019 are cited

Broad overview of concepts and general principles relating to Income-tax Law and Goods and Services Tax Law, with apt illustrations have been given for easy understanding

Easy approach to learn the principles relating to computation of taxable income under each head of in come together with suitable formats prescribe Apt illustrations, case studies and exercises are provided

For Practice of students’ multiple choice questions (MCQ) have been included at the end of this book

“Summary of Key points” is provided at the end of each chapter so as to enable the students to comprehend And grasp the subject in an effective manner

Questions of past 21 examinations of The Institute of Chartered Accountants of India suitably modified and answered on the bas is of law applicable for the assessment year 2020-21, are included chapter wise. Problems on computation of total income and tax liability are solved exclusively

Recent amendments, though incorporated at appropriate places, are separately listed in Appendix in order to enable effective revision by the students

Topic wise exclusions from the CA Intermediate Course (New) and CA (Integrated Professional Competence) Course (Old) as per the ICAI study guidelines have been dealt accordingl

Contents

Syllabus for CA Intermediate Course (New)

Syllabus for CA Intermediate (Integrated professional competence course) Course (Old)

Arrangement of Sections

Pattern of Distribution of Marks

Recent Amendments – AY 2019- 20

Suggested Answers for CA Inter(New) Nov 2019 Examination

Income Tax

Preliminary

Basis of Charges

Incomes which do not form part of Total Income

Computation of Total Income

Salaries

Income from House Property

Profits and Gains of Business or Profession

Capital Gains

Income from Other Sources

Income of Other Persons, included in Assessee’s Total Income

Aggregation of Income and Set Off or Carry Forward of Loss

Deductions to be made in Computing Total Income

Rebatos and Relief

Heads of income at a Glance

Filing of Return of Income

Tax Deduction at Source and Introduction to Tax Collection at Source

Advance Tax, Self Assessment and Interest

Revision – Problems on Computation of Total Income and Tax Liability

Indirect Tax

GST – An Introduction

Taxable Supply

Charge of GST

Exemptions from GST

Time of Supply & Value of Supply

Input tax credit

Registration

Tax Invoice, Credit and Debit Notes

Payment of lax

Returns

Computation Problems

MCQ for Income Tax and IDT