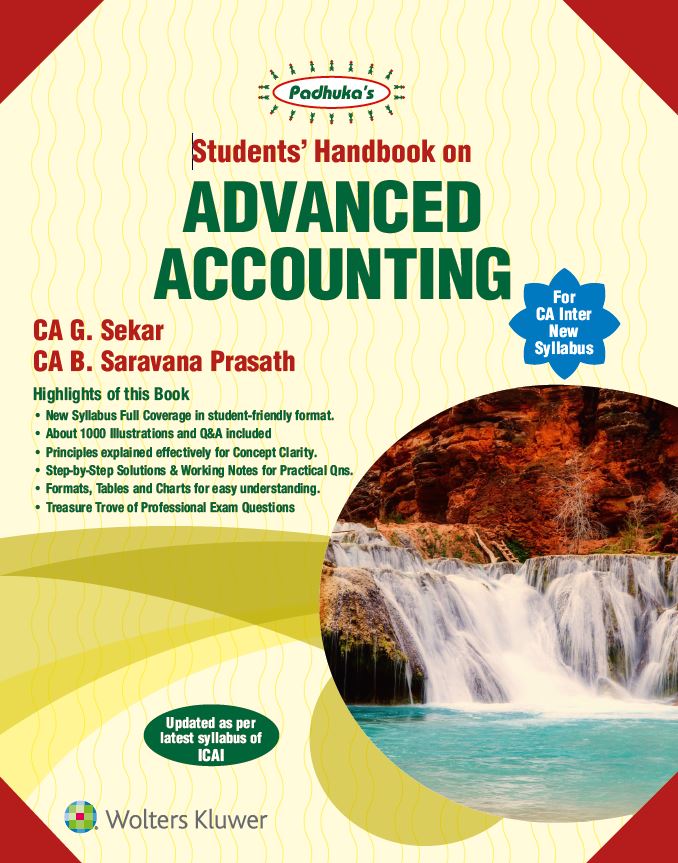

Padhuka CA Inter Accounting Group-1 for May 2020 (New Syllabus) By CA G Sekar & B Saravana Prasath

This Book is useful for CA Inter students (New Syllabus) Appearing in May 2020 Exam and onward.

₹1,149

₹999

Safe and Secure Payments. Easy returns. 100% Authentic products.

Safe and Secure Payments. Easy returns. 100% Authentic products.

|

HAVE QUERIES? GET QUICK HELP

CHECK CASH ON DELIVERY AND NEXT DAY DELIVERY AT YOUR LOCATION:

- Cash on Delivery

- Next Day Delivery

Customers who bought this item also bought:

General Information:

-

Publication: Padhuka

-

Author: G. sekar

-

Cover: Paperback

-

Language: English

-

Study Material Format: Printed Books

-

Edition: 12th

-

Exam Attempt: November 2019

-

ISBN Number: 9789386691996

-

Useful For: CA Inter

Highlights of this Book

• New Syllabus Full Coverage in a student-friendly format.

• Companies Act, 2013 Relevant Provisions updated.

• All Relevant Accounting Standards included.

• About 1000+ solved Illustrations and Q&A included.

• Principles explained effectively for Concept Clarity.

• Step-by-Step Solutions & Working Notes for Practical Qns.

• Formats, Tables and Charts for easy understanding.

• Single Handy Tool for Exams & Practical Learning.

• Treasure Trove of Professional Exam Questions

Contents -

PART A Non Corporate Accounting Areas

Accounting Basics – Conceptual Framework

Accounting for Investments (including Accounting Standard – 13)

Insurance Claims

Accounting for Hire Purchase Transactions

Departmental Accounts

Branch Accounts

Single Entry System – Accounting from Incomplete Records

Partnership Accounts (Dissolution, Sale to Company, Amalgamation)

PART B Corporate Accounting Areas

Accounting for Shares

Accounting for Debentures

Profits Prior to Incorporation

Final Accounts of Companies

PART C Accounting Standards

AS – Introduction and Applicability

AS – 1 – Disclosure of Accounting Policies

AS – 2 – Valuation of Inventories

AS – 3 – Cash Flow Statements

AS – 4 – Contingencies & Events Occurring after the Balance Sheet Date

AS – 5 – Net Profit or Loss for the Period, Prior Period Items and Changes in Accounting Policies

AS – 10 – Property, Plant and Equipments

AS – 11 – The Effect of Changes in Foreign Exchange Rate

AS – 12 – Accounting for Government Grants

AS – 16 – Borrowing Costs

AS – 17 – Segment Reporting

AS – 22 – Accounting for Taxes on Income

About the Author -

G. Sekar completed his B.Sc. Chemistry in Dharmapuri Arts College (University of Madras; 1993) and M.Sc. Organic Chemistry in Department of Organic Chemistry, Guindy Campus, University of Madras (1995; M.Sc. thesis guide: Prof. P. Rajakumar). He obtained his Ph.D. in synthetic organic chemistry from Indian Institute of Technology Kanpur in 1999 under the guidance of Padma Shri Prof. V. K. Singh. He has carried out his JSPS postdoctoral fellowship at Toyohashi University of Technology, Japan (with Prof. H. Nishiyama; Apr. 2000 – Jun. 2001), AvH postdoctoral fellowship at University of Goettingen, Germany (with Prof. L. F. Tietze; Jul. 2001 – Dec. 2002) and senior postdoctoral fellowship at Caltech, USA (with Prof. Brian M. Stoltz; Feb. 2003 – Dec. 2004), prior to joining IIT Madras in December 2004 where he is presently holding Professor position