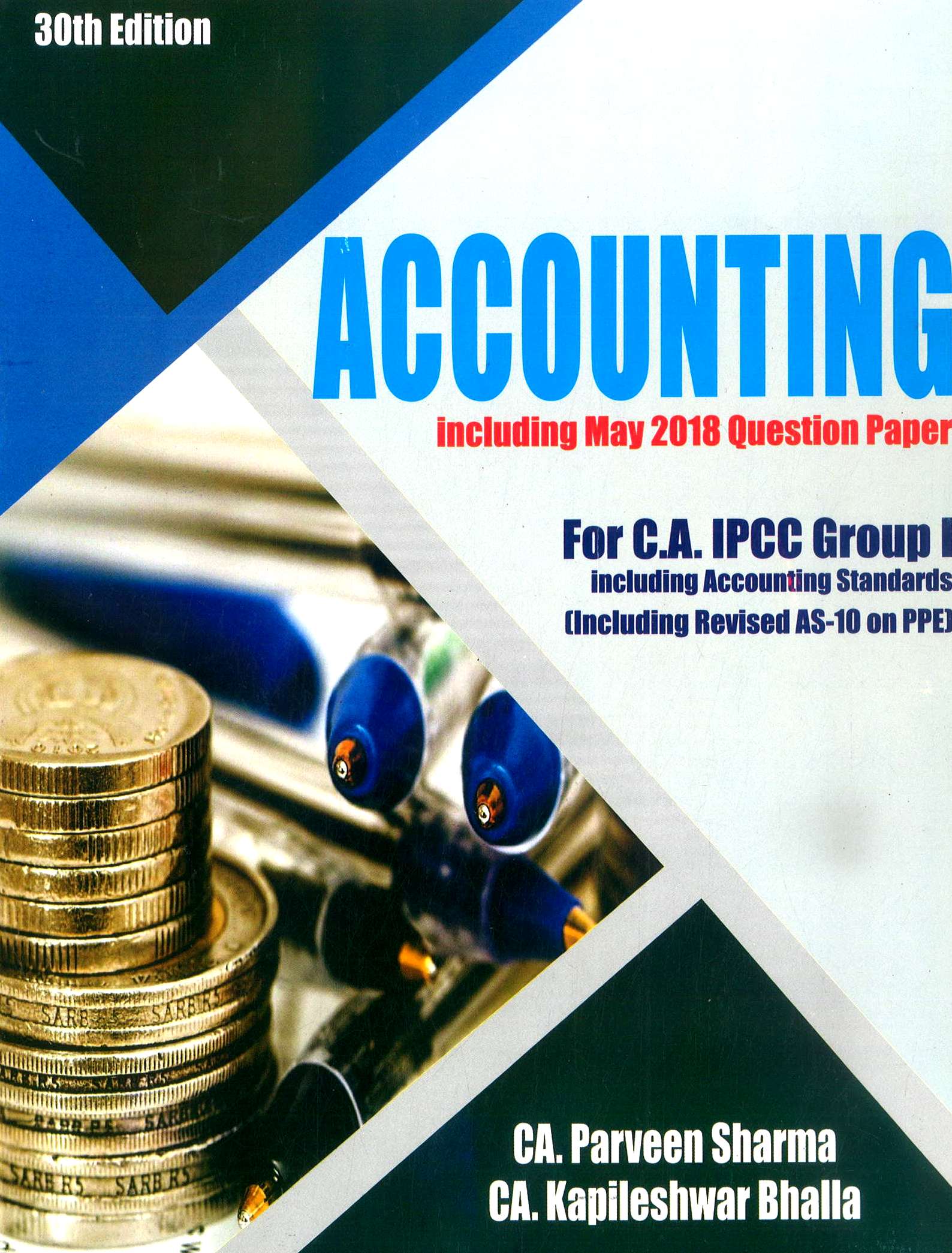

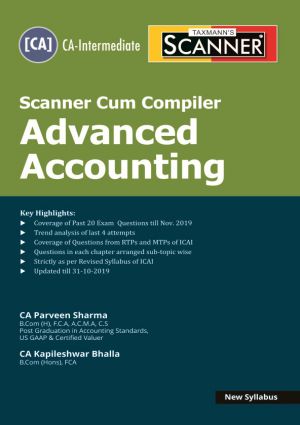

Advanced Accounting CA Intermediate Gruop 2 By CA Parveen Sharma & CA Kapileshwar Bhalla

This Book is useful for CA IPC GROUP 2 students New Syllabus Appearing in May.2018 Exam and onward.

₹1,050

Safe and Secure Payments. Easy returns. 100% Authentic products.

Safe and Secure Payments. Easy returns. 100% Authentic products.

|

HAVE QUERIES? GET QUICK HELP

CHECK CASH ON DELIVERY AND NEXT DAY DELIVERY AT YOUR LOCATION:

- Cash on Delivery

- Next Day Delivery

Customers who bought this item also bought:

General Information:

-

Publication: Pooja Law House

-

Cover: Paperback

-

Language: English

-

ISBN Number: 2017050000742

-

Edition: 30th

-

Useful For: CA Intermediate

For a thorough grasp on the subject of Advanced Accounting adequate practice is required which involves conceptual knowledge and practicing variety of numerical problems. In light of the changes in Companies Act, 2013 and its impact on accounting it is very important that information about terms, accounting conventions and concepts along with relevant provisions of law is handy to the student while working on accountancy problems. The present book is specially designed for the new course of CA-Intennediate level to enable the students to acquire conceptual base through theory and illustration. In each chapter various sections have been introduced so that the student understands the types of problems he can confront in the exam. Then a section pertairting to exercise questions has been added at the end of each chapter. This will test the student in identifying his weakness areas whereupon he can take corrective action. Questions have been taken from the latest examination papers of the various Universities and Professional Bodies. The books is specially designed for the students studying at the Intermediate level of Institute of Chartered Accountants of India. A few new chapters have been introduced in the new course, which were earlier a part of the Final level. Past examination questions from Final level have been incorporated for better understanding and practice. The subject has been introduced in a systematic manner and for a self-study approach. At the beginrting of the book a complete chapter on Accounting Standards has been added to provide complete understanding of the nuances of Accounting Standards with past year solved examination problems given standard-wise. The standards have been explained with diagrams and simple language to give a conceptual understanding. There have been changes in the Accounting standards also by MCA on 30th March, 2016. These changes have been incorporated at relevant places. This book has been thoroughly revised keeping in the latest changes in Companies Act, 2013 and Accounting Standards

Contents -

Chapter 1 Accounting Standards

AS 7 Construction Contracts

AS 9 Revenue Recognition

AS 14 Amalgamation of Companies

AS 18 Related Party Disclosures

AS 19 Leases

AS 20 Earnings Per Share

AS 24 Discontinuing Operations

AS 26 Intangible Assets

AS 29 Provisions, Contingent Liabilities and Contingent Assets

Chapter 2 Guidance Notes

Questions based on Schedule III 234

Chapter 3 Accounting for Employee Stock Option Plan

Accounting for Employee Stock Option Plan (ESOP) & Employee Stock Purchase Plan (ESPP) 250

Accounting for Stock Appreciation Rights (SAR) SELF-PRACTICE

Chapter 4 Buy Back of Securities & Equity Shares with Differential Rights

Chapter 5 Underwriting of Shares & Debentures EXERCISE

Chapter 6 Amalgamation of Companies

Computation of PC

Merger (Pooling of Interest Method)

Purchase Method

Advanced problems

Chapter 7 Internal Reconstruction

Chapter 8 Liquidation of Companies

List B Contributory

Statement of Affairs

Liquidator’s Final Statement of Accounts EXERCISE

Chapter 9 Accounting for Insurance Companies

Basic Questions

Valuation Balance Sheet

Final Accounts 526 EXERCISE

Chapter 10 Accounting for Banking Companies

Non Performing Assets

Tier I and Tier II Capital

Bill Discounted etc.

Investment Valuation

Acceptance, Endorsement, etc

Cash Reserve Ratio

Statutory Liquidity Ratio

Bills for Collection

Final Accounts EXERCISE

Chapter 11 Non Banking Finance Company

Theory Questions

PRACTICAL QUESTIONS

SELF-PRACTICE QUESTIONS

Chapter 12 Mutual Fund

Theory Questions

PRACTICAL QUESTIONS

Chapter 13 Valuation of Goodwill

Basic Concepts – Capital Employed and FMP

Basic Questions

Advanced Questions

Leverage Effect on Goodwill PRACTICE QUESTIONS

Chapter 14 Holding Company Accounts

1. Comprehensive Questions

Consolidated Profit & Loss Account