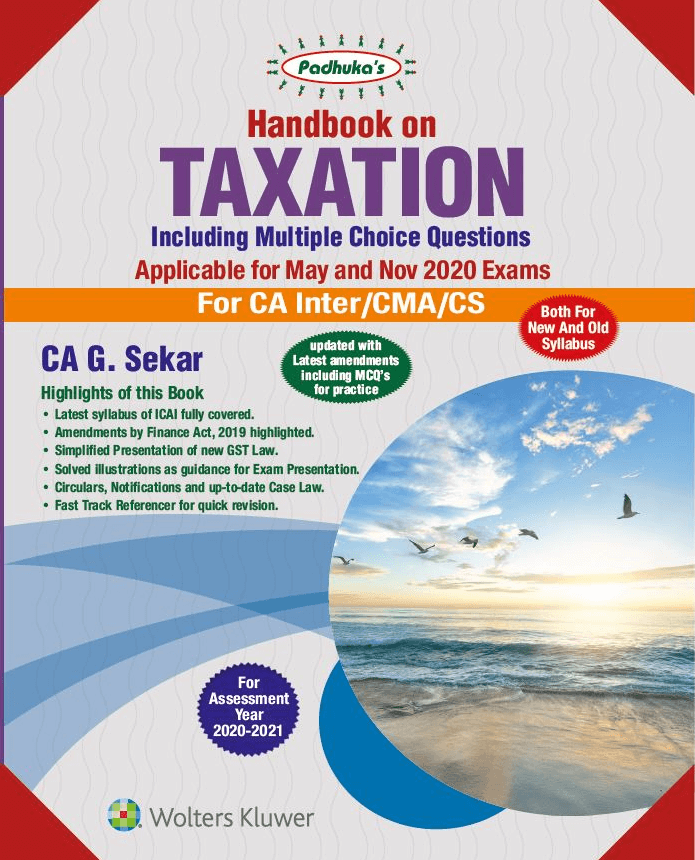

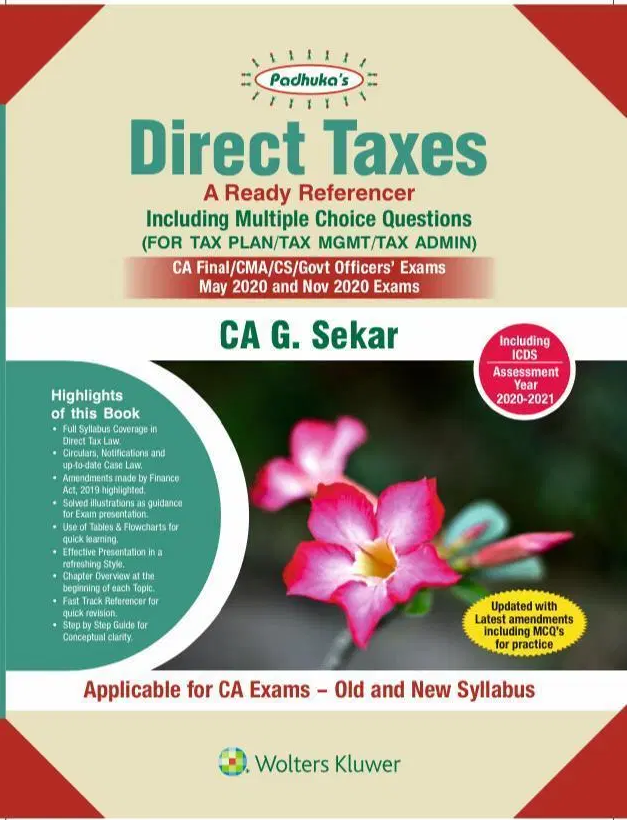

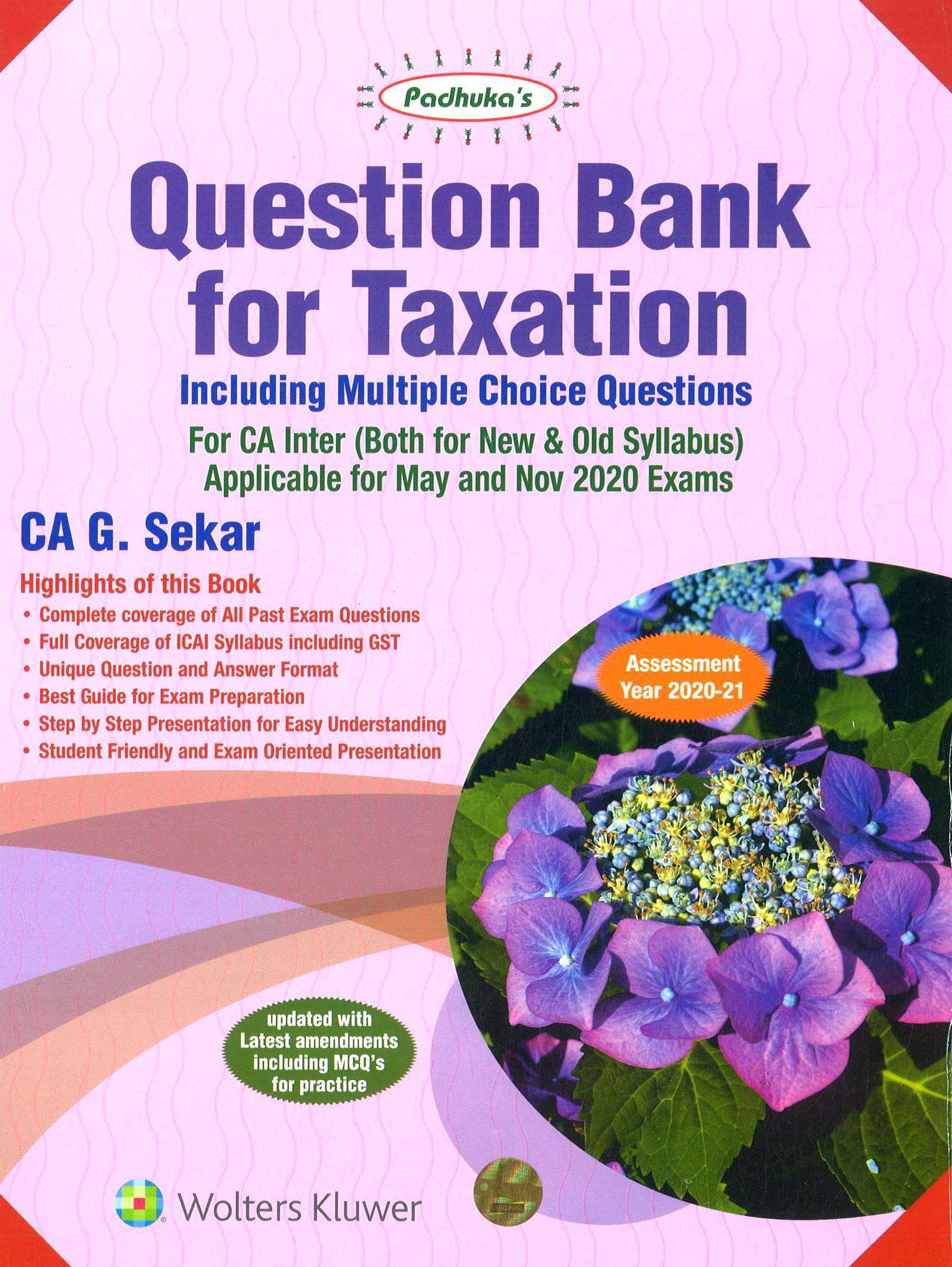

padhuka CA inter Taxation for May/Nov. 2020 By Ca G Sekar

This Book is useful for CA inter /CMA / Ipcc / CS, old & New Syllabus students Appearing in May 2020 Exams

₹1,398

₹1,215

Safe and Secure Payments. Easy returns. 100% Authentic products.

Safe and Secure Payments. Easy returns. 100% Authentic products.

|

HAVE QUERIES? GET QUICK HELP

CHECK CASH ON DELIVERY AND NEXT DAY DELIVERY AT YOUR LOCATION:

- Cash on Delivery

- Next Day Delivery

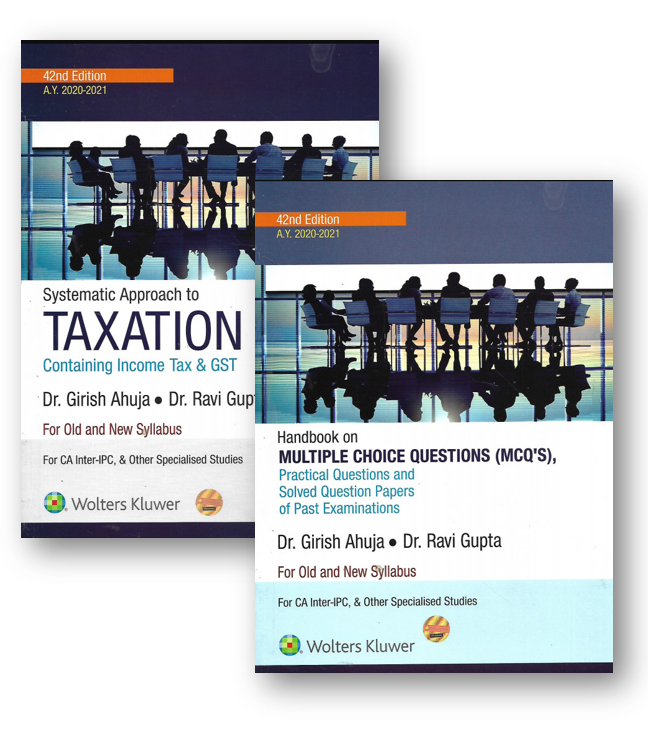

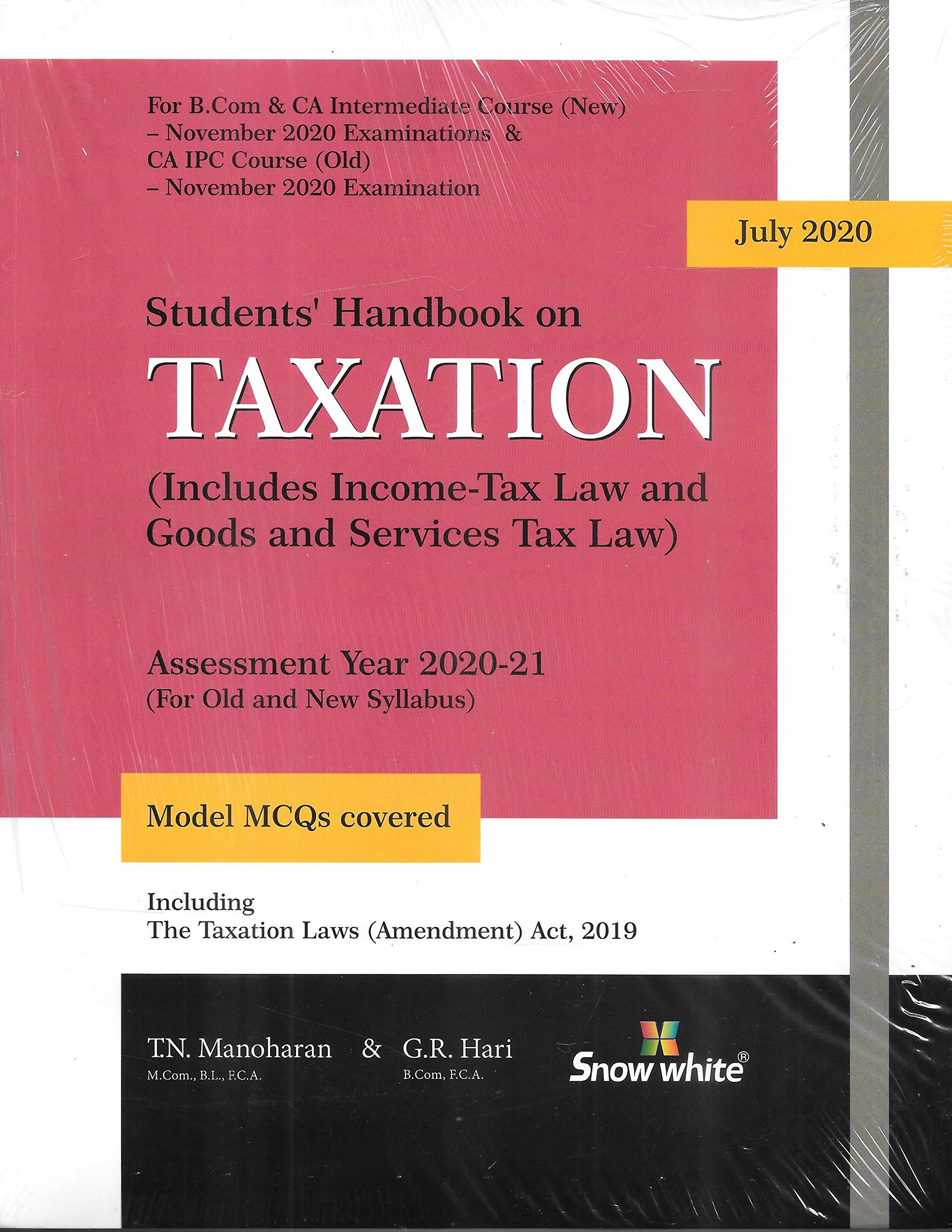

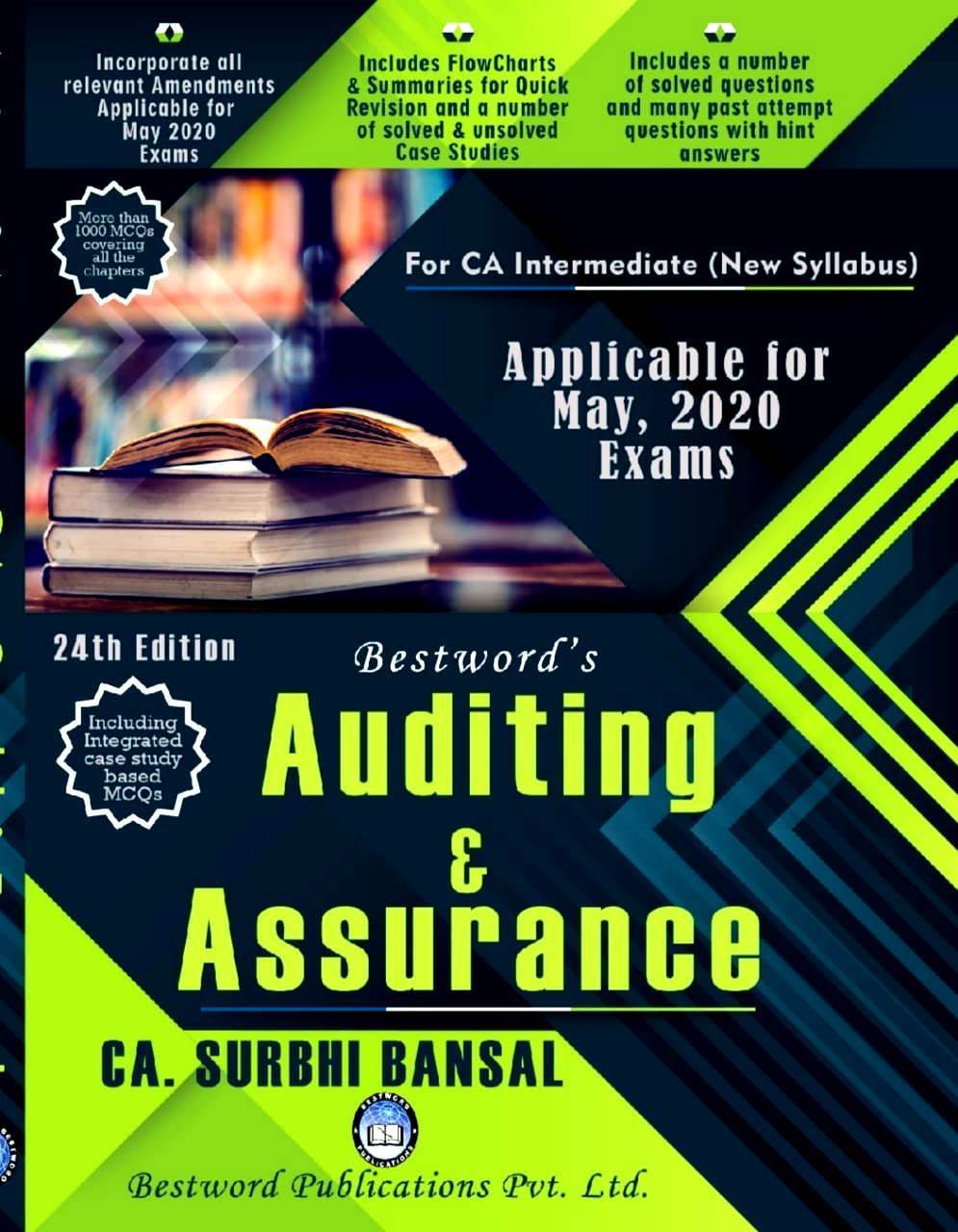

Customers who bought this item also bought:

General Information:

-

Author: G. sekar

-

Publication: Wolters Kluwer

-

Cover: Paperback

-

Language: English

-

ISBN Number: 9789389702064

-

Edition: 21st

-

Useful For: CA Inter / Ipcc Old & New Syllabus

-

Exam Attempt: May/November 2020

Highlights of this Book -

Including new GST Law for Assessment year 2020-21

Highlights of this Book

Latest Syllabus of ICAI fully

Amendments by Finance Act, 2019 Highlighted.

Simplified Presentation 01 new GST

Solved illustrations as guidance for Exam Presentation.

Circulars, Notifications and up-to-date case

Fast Track Referencer for quick revision.

Contents

Income Tax

Basic Concepts in Income Tax Law

Residential Status and Taxability in India

Exemptions under Income ‘Tax Act

Income from Salaries

Income from House Property

Profits and Gains of Business or Profession

Capital Gains

Income from Other Sources

Income of Other Persons included in Assessee’s Total Income

Set off and Carry Forward of Losses

Deductions under Chapter VI-A

Rebate and Relief

Advance Tax & Interest

Agricultural Income

Taxation of Individuals

Taxation of HUF

Return of Income

Tax Deducted at Source

Goods and Services Tax (GST)

Basic concepts of CST

GST – Levy and Collection of Tax

GST _. Exemptions

Time and Value of Supply

Input Tax Credit

Registration

Tax Invoice, Credit and Debit Notes

Payment

Returns

About the Author

G. Sekar completed his B.Sc. Chemistry in Dharmapuri Arts College (University of Madras; 1993) and M.Sc. Organic Chemistry in Department of Organic Chemistry, Guindy Campus, University of Madras (1995; M.Sc. thesis guide: Prof. P. Rajakumar). He obtained his Ph.D. in synthetic organic chemistry from Indian Institute of Technology Kanpur in 1999 under the guidance of Padma Shri Prof. V. K. Singh. He has carried out his JSPS postdoctoral fellowship at Toyohashi University of Technology, Japan (with Prof. H. Nishiyama; Apr. 2000 – Jun. 2001), AvH postdoctoral fellowship at University of Goettingen, Germany (with Prof. L. F. Tietze; Jul. 2001 – Dec. 2002) and senior postdoctoral fellowship at Caltech, USA (with Prof. Brian M. Stoltz; Feb. 2003 – Dec. 2004), prior to joining IIT Madras in December 2004 where he is presently holding Professor position His research interests lie in the areas of asymmetric synthesis, total synthesis of biologically active natural products, and synthesis and application of chiral nanocatalysts.