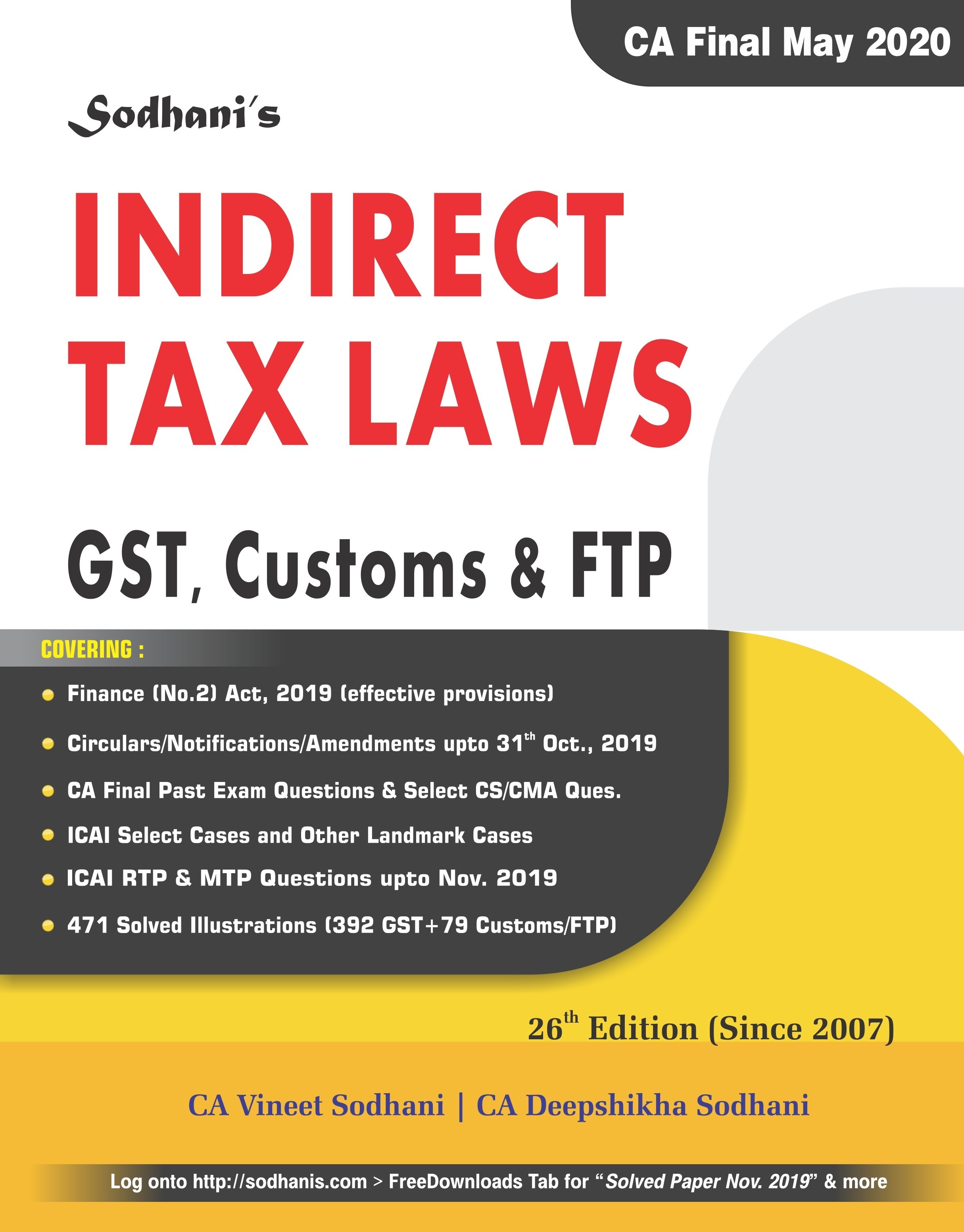

CA Final Indirect Tax Laws For May 2020 by Vineet Sodhani Deepshikha Sodhani

This Book is useful for CA Final old and New Syllabus students Appearing in May 2020 Exam .

₹1,400

₹1,220

Safe and Secure Payments. Easy returns. 100% Authentic products.

Safe and Secure Payments. Easy returns. 100% Authentic products.

|

HAVE QUERIES? GET QUICK HELP

CHECK CASH ON DELIVERY AND NEXT DAY DELIVERY AT YOUR LOCATION:

- Cash on Delivery

- Next Day Delivery

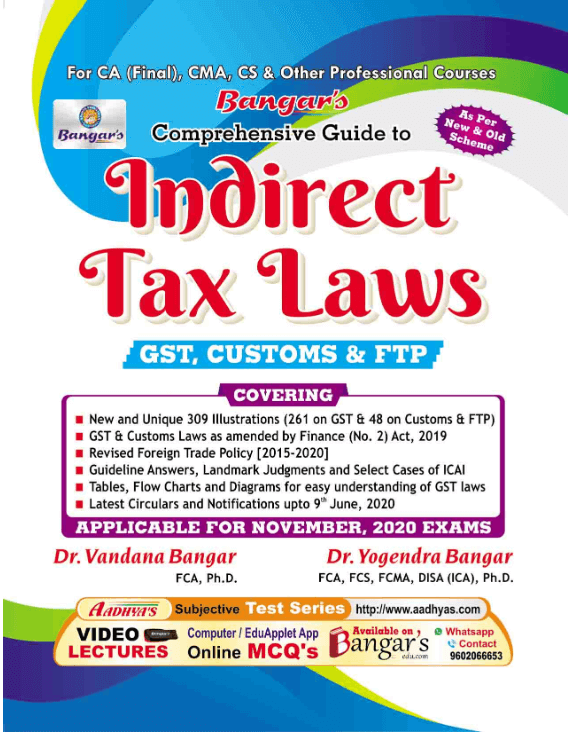

Customers who bought this item also bought:

General Information:

-

Cover: Paperback

-

Language: English

-

ISBN Number: 9788193648575

-

Number of Pages: 762

-

Edition: 26th, 2020

-

Useful For: CA Final students

Goods & Services Tax (GST)

COVERING:

Excluding deleted Topics in GST/Customs

Circular/Notification/Amended upto 31-0ct-2019

Finance (No.2) Act, 2019 (effective provisions)

ICAI Select Cases & Advance Rulings on GST

GST (392 Illustrations) + Customs (79 Illustrations)

471 [392 in GST & 79 in Customs/FTP Book]

RTPs and MTPs upto Nov. 2019

ICAI Select Cases + Advance Rulings on GST by AAR/AAAR

Customs & Foreign Trade Policy

COVERING -

As per Revised Syllabus for Nov. 2019 announced on 26-June-2019 by ICAI

Circulars, Notifications & amendments up to 30th Apri, 2019

CA Final Exam /RTP Ques. & Solved Papers May 2019 (Old & New)

ICAI Select Cases, Landmark Cases & Select RTP/CS/CMA Ques

92 Solved Illustrations & 117 Multiple Choice Questions

Contents -

Volume – 1 – Goods & Services Tax (Gst)

Div. 1 - Gst – Basic Concepts & Meaning Of Supply

Introduction, Constitutional Amendments & General Definitions

Definitions : Person, Deemed Distinct Persons, Related Person Business, Goods & Service

Meaning & Scope Of Supply

Supply Related Concepts, Aggregate Turnover And Composite & Mixed Supply

Div.2: Gst – Charge Of Gst, Time Of Supply & Valuation

Charge Of Cgst, Utgst/Sgst, Igst & Compensation Cess

Time Of Supply Of Goods & Services, And, Change In Rate Of Tax

Meaning Of Consideration & Valuation Of Supply

Div. 3: Gst – Place Of Supply, Import, Export & Incentives

Place Of Supply Of Goods

Place Of Supply Of Services

Inter· State & Intra,State Supplies

Import & Export; Export Incentives And Zero·Rated Supply & Sezs

Div.4: Gst – Exemptions, Rate Of Tax, Tds, Tcs & Reverse Charge

Threshold Exemption, Composition Scheme & Exemptions For Goods

Person Liable To Pay Tax And Reverse Charge

Tax Deduction At Source (Tds), Tax Collection At Source (Tcs) & E Commerce Operators

Div.5 - Gst -Input Tax Credit

Basics Of Input Tax Credit: Input, Input Service & Capital Goods

Credit – Availment & Utilization (Eligible & Ineligible Items Conditions, Documents & Time)

Credit: ‘Personal Use’, ‘Exempted Supplies’, Composition Scheme, New Registrations & Transfer Of Business

Credit Job- Work Input Service Distributor, Matching & Procedures

Div.6 - Gst – Taxation Of Services [Rates, Exemptions, Rcm & Illus.]

Taxation Of Services Sector Wise Business Wise Analysis

Div.7 - Admn, Reg, Invoice, Payment, Return, Assessment & Refund

Administration Of Gst & Registration Under Gst

Invoices, Accounts & Records And Payment, Interest & Accounting Entries

Returns & Assessment

Unjust Enrichment & Refunds And Anti,Profiteering Measure

Div.8 - Gst – Powers, Demands, Recoveries & Penalties

Audits, Inspections, Summons, Visits And Search & Seizure

Demands, Recoveries & Adjudication And Liability In Special Cases

Penalties, Confiscation, Prosecution & Arrests & Circulars & Other Powers

Div.9 - Gst – Remedies: Advance Rulings, Appeals & Revision

Advance Rulings & Appeal There against

Appeals, Revision And Miscellaneous Provisions

Div. 10 - Transitional Provisions

Transitional Provisions

Volume – 2 – Customs & Foreign Trade Policy

Div.1 - CUSTOMS – CHARGE, VALUATION & CLASSIFICATION

BASICS AND CHARGE Of DUTY

CUSTOMS VALUATION

CLASSIFICATION, TARIFF & VARIOUS DUTIES

Div.2 - CUSTOMS -IMPORT AND EXPORT: PROCEDURE AND POWERS

IMPORT, EXPORT & WAREHOUSING PROCEDURES

CUSTOMS : DRAWBACK, BAGGAGE, POSTAL ARTICLES, STORES & COASTAL GOODS

CUSTOMS: POWERS, CONTROL, PROCEDURES, CONFISCATION AND PENALTIES

Div. 3 - GENERAL PROCEDURES UNDER CUSTOMS

CUSTOMS: RECOVERY & INTEREST, EVASION PENALTY & PUNISHMENT AND CIRCULARS, EXEMPTIONS & REFUNDS

CUSTOMS: ADVANCE RULINGS & SETTLEMENT OF CASES

CUSTOMS: APPEALS, REVIEW & REVISION

Div. 4 - FOREIGN TRADE POLICY

FOREIGN TRADE POLICY – BASICS, SCHEMES, EOUs & SEZs

SOLVED PAPER May 2018

About the Author:-

Vineet Sodhani

• Secured AIR-11th in CA PE-I and AIR-3rd in CA PE-II

• Secured AIR-lst in CA Final Nov. 2006 with 621 marks and Best paper

award in DT (94 marks)

• Secured AIR-lst in CS Inter and AIR-3rd in CS Final

• Author and Editor of various books and magazines on Taxation

• Faculty and Consultant in Tax Laws

• Visiting faculty at ICAI branches & CPE Seminars

• Guiding Students of Professional Courses

Deepshikha Sodhani

• Meritorious Student Always

• Author of Taxation books at various levels

• Providing consultancy in tax and corporate laws

• A contemporary writer of various research papers published in reputed legal journals

• Guiding Students of Professional Courses