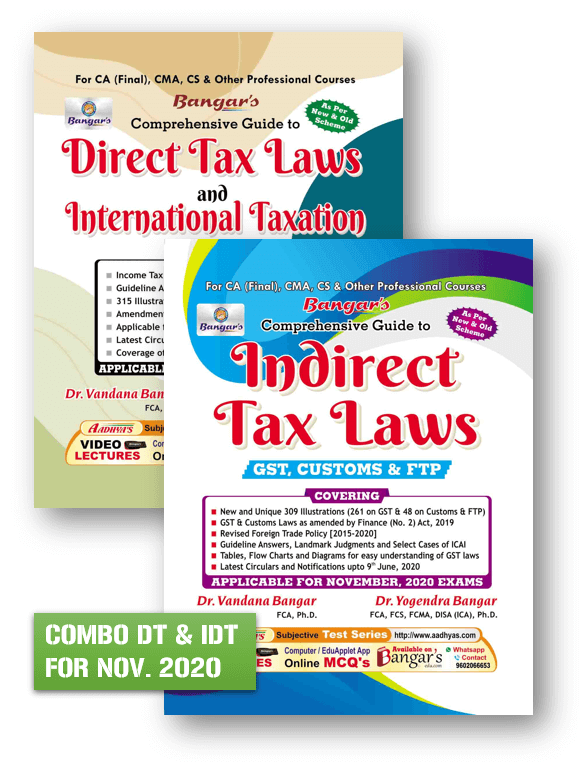

IDT-Indirect Tax Laws (GST + Custom) Detailed Book for CA Final Nov. 2020 By Yogender Bangar, Vandana Banar

This book covers the syllabus prescribed for CA Final New Scheme and Old Scheme and useful for CA Final students Appearing in November 2020 Exam.

₹1,450

₹1,295

Safe and Secure Payments. Easy returns. 100% Authentic products.

Safe and Secure Payments. Easy returns. 100% Authentic products.

|

HAVE QUERIES? GET QUICK HELP

CHECK CASH ON DELIVERY AND NEXT DAY DELIVERY AT YOUR LOCATION:

- Cash on Delivery

- Next Day Delivery

Customers who bought this item also bought:

General Information:

-

Author: Yogendra Bangar

-

Publication: Aadhya Prakashan

-

Cover: Paperback

-

Language: English

-

ISBN Number: 9788190502696

-

Number of Pages: 796

-

Edition: 16th Edition

-

Useful For: CA Final , CMA , CS &other professional courses

-

Exam Attempt: November 2020

Comprehensive Guide to "Indirect Tax Laws (GST, CUSTOMS & FTP)"

It is with great pride and pleasure that we bring to you our book on Indirect Taxes — “Comprehensive Guide to Indirect Tax Laws” that has not only enjoyed great market success but has also received the appreciation of our dear readers. This book covers the syllabus prescribed for CA Final New Scheme and Old Scheme.

This book incorporates the following –

Analysis of the provisions of CGST Act, 2017, IGST Act, 2017 and Relevant Rules, 2017;

GST & Customs Law as amended by Finance (No. 2) Act, 2019;

New and Unique 309 Illustrations [261 on GST & 48 on Customs & FTP] arranged Topic-wise/ Section-wise and Select Past Examination Questions;

Tables, Flow Charts and Diagrams for easy understanding and Quick Recap of GST laws;

Revised Foreign Trade Policy [2015-2020];

Landmark Judgments & Select Cases of ICAI;

All the latest developments in the Indirect Tax Laws, including latest Circulars and Notifications upto June 9th, 2020.

SUBJECT INDEX :

■ SECTION A : GOODS AND SERVICES TAX (GST)

1. GST in India - A Brief Introduction

2. Supply under GST

3. Charge of GST

4. Composition Levy

5. Exemption from GST

6. Place of Supply

7. Export and Import

8. Time of Supply

9. Value of Supply

10. Input Tax Credit

11. Registration

12. Tax Invoice Credit & Debit Notes and E-Way Bill

13. Accounts and Records

14. Payment of Tax, TDS & TCS

15. Returns

16. Refunds

17. Assessment and Audit

18. Inspection, Search, Seizure and Arrest

19. Administration, Demands and Recovery

20. Liability to Pay in Certain Cases

21. Advance Ruling

22. Appeals and Revision

23. Offences and Penalties

24. Job Work and Miscellaneous Provisions

■ SECTION B : CUSTOMS

25. Basic Concepts

26. Classification & Types of Customs Duties

27. Valuation

28. Importation and Exportation

29. Duty Drawback

30. Baggage, Postal Articles & Stores

31. Exemptions and Refunds

■ SECTION C : FOREIGN TRADE POLICY

32.Foreign Trade Policy (2015-2020)

About The Author

Mr. Bangar a member of ICAI, is the founder and pioneer of AADHYAS – Academy and Prakashan. A thorough educationist and a self made man with an excellent academic record throughout, he laid the foundation stone of Aadhya Academy in 1996. Beginning with table coaching to a couple of students, he has over the years, step by step with great determination and hardwork built a strong “Knowledge based” education support system providing a platform to aspiring students to pursue and achieve their goals. He believes in the saying, “Learn as if you were to live forever”, it is his continuous thirst for knowledge that has gained him a name amongst intellectual heads in the renowned Institutes of Commerce. His commitment for quality education has enabled him to develop a unique method of teaching and learning which retains the strong characteristics of conservative learning and teaching methods developed in lines with the latest technologies. Thus, blending the values of traditional system with the modern concept of education with technology.

Being a student himself and realising the dearth of a comprehensive, conceptual book which would act as an effective tool to face the real challenge – 'Exams', he entered into the field of publication authoring books on Tax Laws. With his first edition being published in 2001, the books have received overwhelming response from students all over. His long and direct association with students which has been a boon to him, has helped him in understanding the students' psychology and the problems faced by them. This, in turn has helped him to design his books in a simple and understandable form which has been highly appreciated by the students. A God fearing person and a man of principles with values like honesty, integrity, soft spoken, dedication, sincerity, perseverance, hardworking adorning his personality, he is the strongest pillar of the house of AADHYAS.

Subject Handling:

Direct and Indirect Taxation

Education:

B.Com. (Hons.)

FCA

FICWA

ACS

DISA (ICA)

Research:

All India Rankholder in CS Inter (1st) and CS Final (2nd) Exams

Rank holder in CA Exams

A well-renowned faculty teaching Direct and Indirect Taxation

Author of various books at UG, PG and professional levels

Faculty Member CA, CS and CWA Institute at various branches

Presented papers and delivered lectures in various seminars

Contributed articles to leading magazines like The Chartered Accountant, Taxman, Excise Law Times, Service Tax Review, etc. and various newspapers

Presently engaged in CA Practice

Awards:

Gold Medalist in B.Com. (Hons.) Raj. University