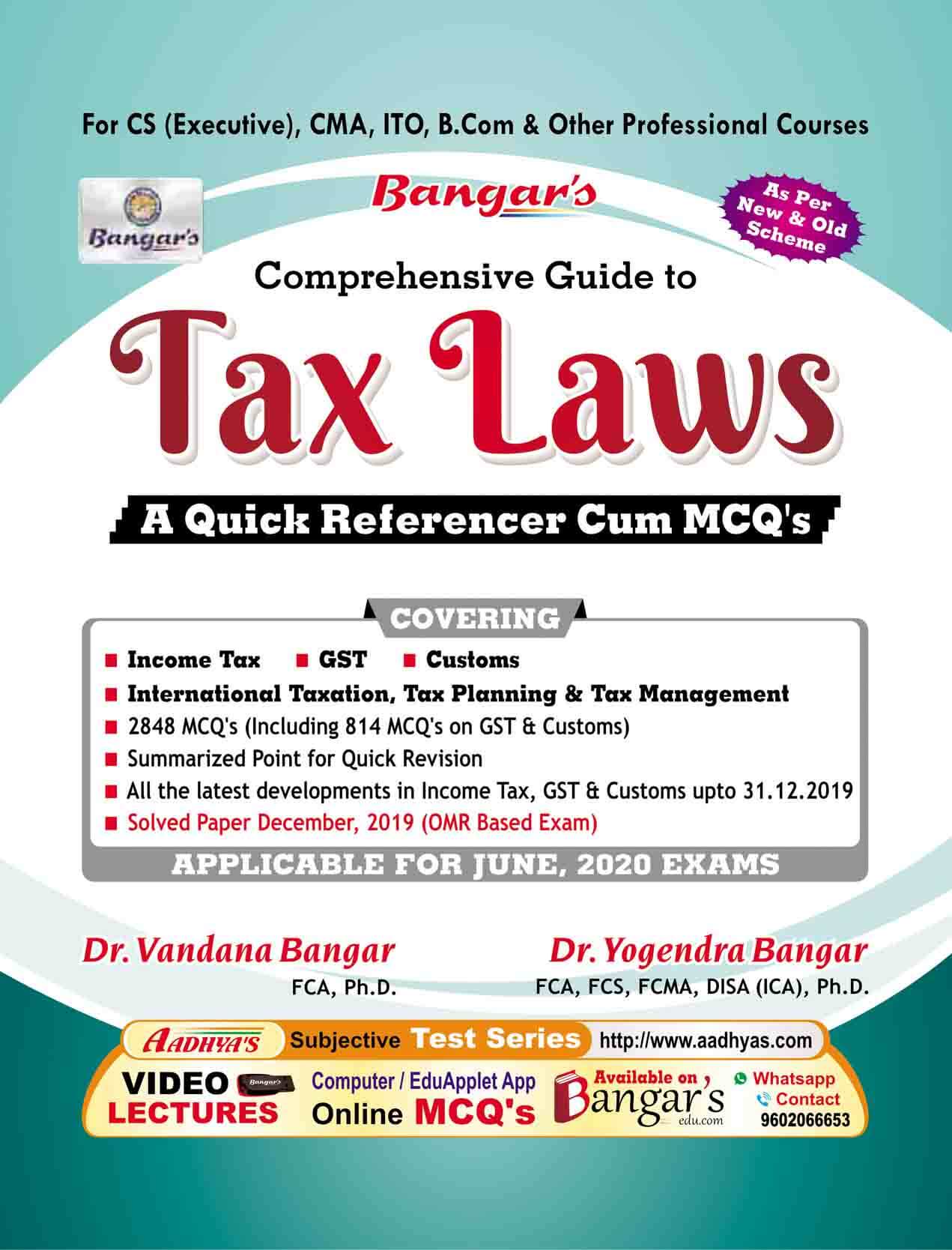

CA final IDT INDIRECT TAX LAW AND PRACTICE COMPILER for May 2023 By yogender Bangar

This Book is useful for CA final Examination for May 2023 Exam . “Indirect Tax Laws (GST, Customs & FTP) – A Quick Referencer cum Compiler”

Safe and Secure Payments. Easy returns. 100% Authentic products.

Safe and Secure Payments. Easy returns. 100% Authentic products.

|

- Cash on Delivery

- Next Day Delivery

-

Author: Dr. Yogendra Bangar

-

Publication: Aadhya Prakashan

-

Cover: Paperback

-

Language: English

-

ISBN Number: 9788190502719

-

Number of Pages: 548

-

Edition: 21th, 2023

-

Useful For: CA Final

-

Exam Attempt: May 2023

This book incorporates the following

- Finance Act, 2022 (Effective Provisions) & all Amendments up to 31st October 2022

- Summarized Points for Quick Revision

- Tables, Flow Charts and Diagrams for Easy understanding & Quick Recap

- New & Unique 370 Illustrations (287 on GIT and 83 on Customs & FTP)

This book incorporates the following

- Finance Act, 2022 (Effective Provisions) & all Amendments up to 31st October 2022

- Summarized Points for Quick Revision

- Tables, Flow Charts and Diagrams for Easy understanding & Quick Recap

- New & Unique 370 Illustrations (287 on GIT and 83 on Customs & FTP)

SUBJECT INDEX

SECTION A : GOODS AND SERVICES TAX (GST)

1.GST in India A Brief Introduction

2.Supply under GST

3.Charge of GST

4.Composition Levy

5.Exemption from GST

6.Place of Supply, Export and Import

7.Time of Supply

8.Value of Supply

9.Input Tax Credit

10.Registration

11.Tax Invoice, Credit and Debit Notes & E-way Bill

12.Accounts and Records

13.Payment of Tax, TDS & TCS

14.Returns

15.Refunds

16.Administration, Assessment and Audit

17.Inspection, Search, Seizure and Arrest

18.Demands, Recovery & Liability to Pay in Certain Cases

19.Advance Ruling, Appeals and Revision

20.Offences and Penalties

21.Job-Work and Miscellaneous Provisions

SECTION B : CUSTOMS

22.Basic Concepts

23.Classification & Types of Customs Duties

24.Valuation

25.Importation and Exportation

26. Warehousing

27.Duty Drawback

28.Baggage, Postal Articles & Stores & Search

29.Exemptions and Refunds

SECTION C : FOREIGN TRADE POLICY