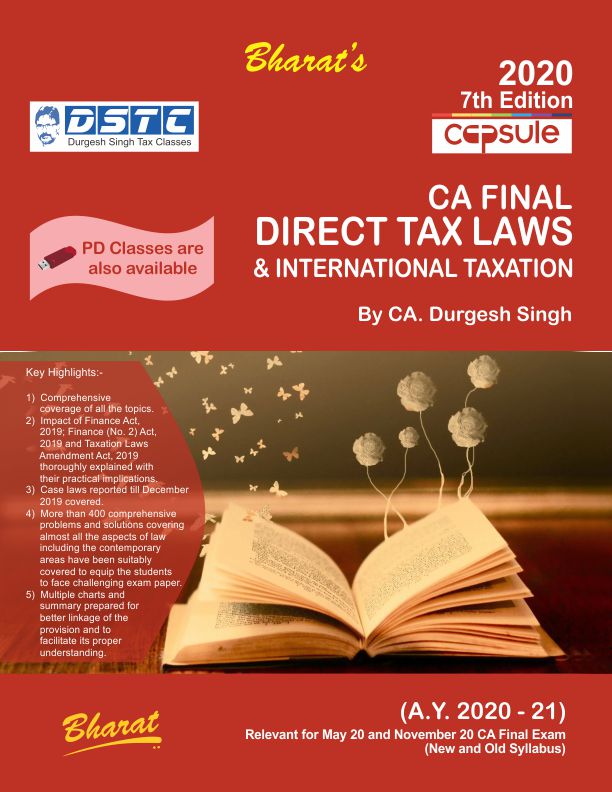

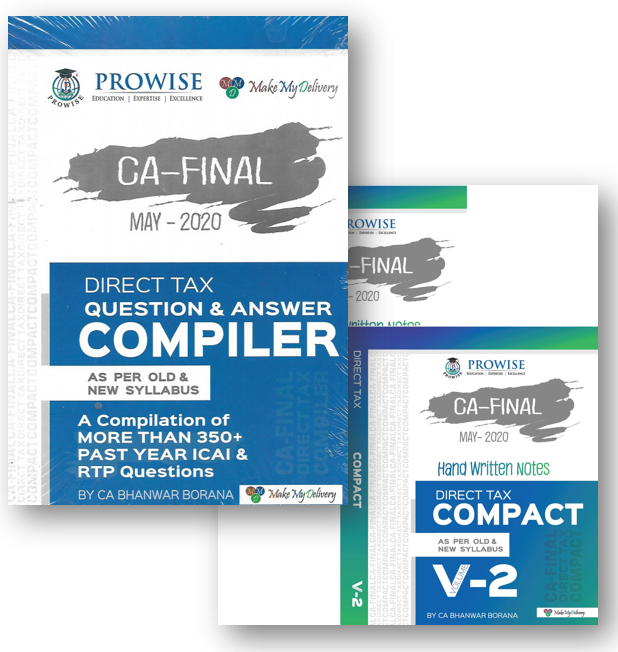

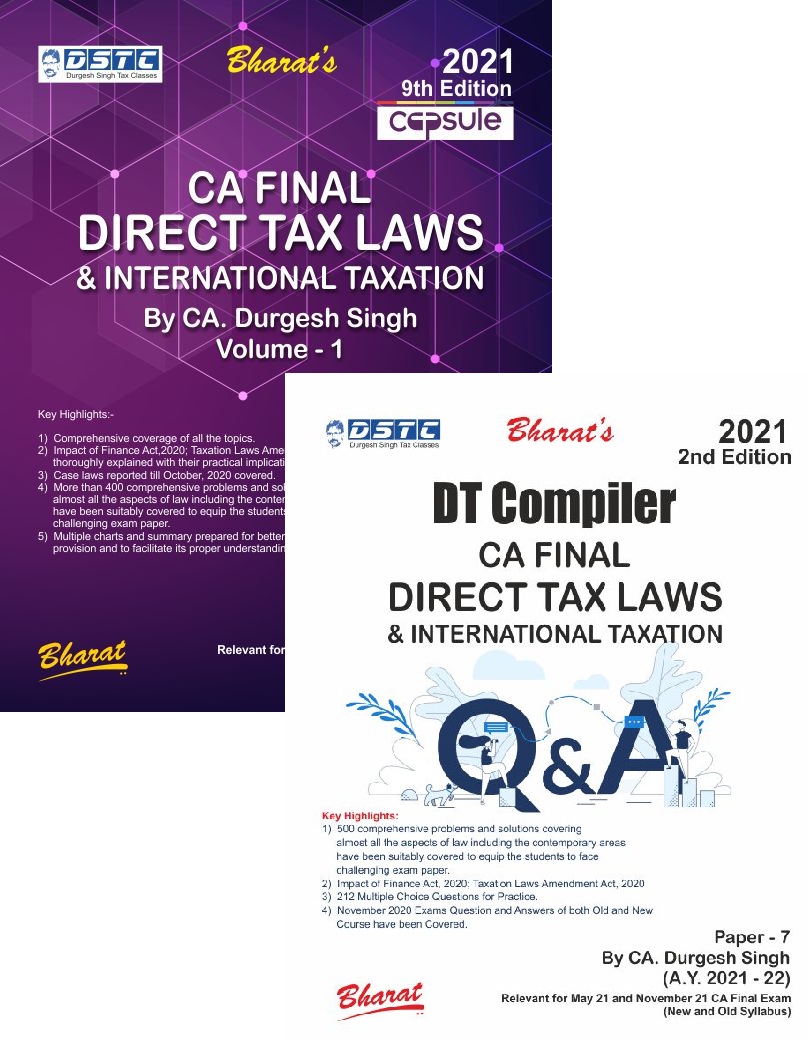

CA Final Direct Tax Laws & International Taxation For May 2020 By CA Durgesh Singh

This Book is useful for CA Final students ( OLD AND NEW SYLLABUS ) Appearing in May 2020 Exams

₹1,495

₹1,315

Safe and Secure Payments. Easy returns. 100% Authentic products.

Safe and Secure Payments. Easy returns. 100% Authentic products.

|

HAVE QUERIES? GET QUICK HELP

CHECK CASH ON DELIVERY AND NEXT DAY DELIVERY AT YOUR LOCATION:

- Cash on Delivery

- Next Day Delivery

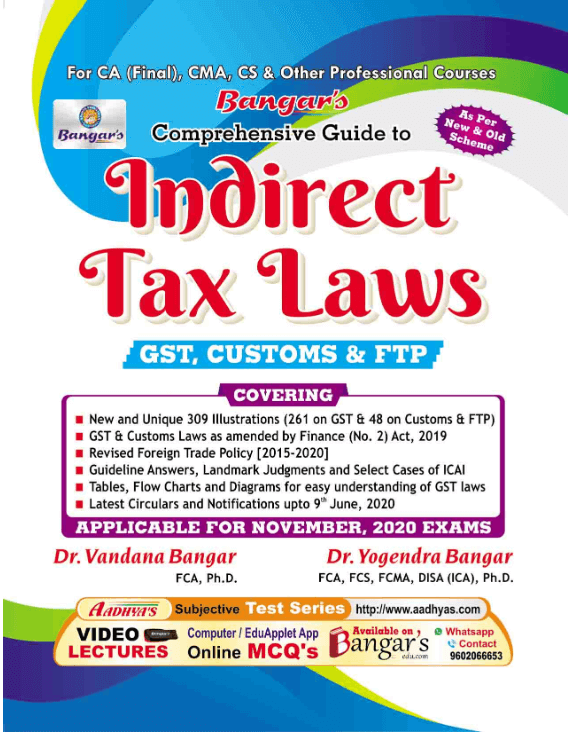

Customers who bought this item also bought:

General Information:

-

Author: DURGESH SINGH

-

Publication: Bharat

-

Cover: Paperback

-

Language: English

-

ISBN Number: 9789386920492

-

Edition: 7th edn., 2020

-

Useful For: CA Final

About CA Final DIRECT TAX LAWS & International Taxation (A.Y. 2020-2021)

This colourful edition shall enable the reader a soothing experience. Further, all amendments of Finance Act, 2019 and the recent notifications have been highlighted in red print so as to enable the reader to discern the amendment portion clearly.

Contents -

Part – AIncome Tax Rates (For A.Y. 2019-20)

Income from House Property

Profits and Gains from Business or Profession

Business Deductions Under Chapter VIA and 10AA

Income Computation and Disclosure Standards (ICDS)

Alternate Minimum Tax (AMT)

Assessment of Partnership Firm

Surrogate Taxes

Capital Gains

Income From Other Sources

Set Off and Carry Forward of Losses

Part – B

Assessment Procedure, Appeals, Revision, Settlement Commission & AAR

Penalties & Prosecution

Miscellaneous Questions & Answer

Part – CClubbing Provisions Hindu Undivided Family Co-Operative Society and Producer Companies Trust, Institutions and Political Parties Assessment of Association of Person (AOP) & Body of Individuals (BOI) Special Tax Rates of Companies Liabilities in Special Cases Chapter VIA Deductions Part – D Tax Deducted at Source (TDS) Tax Collected at Source (TCS) Advance Tax and Interest Part – E International Taxation Transfer Pricing Specific Anti Avoidance Rule (SAAR) (Finance Act, 2018) General Anti Avoidance Rules (GAAR) Concepts & Principles of Interpretation of Double Taxation Avoidance Agreements (DTAAs)/Tax Treaties – (Only for New Syllabus) Base Erosion & Profit Shifting Action Plan - (Only for New Syllabus) Case Laws Appendices

ABOUT THE AUTHOR -

CA. Durgesh Singh has overall 14 years teaching experience at CA Final in Direct & Indirect Taxes. He is immensely popular with students for his teaching ski lls on the subject. With a big four background, he is currently a Partner in a large CA Firm with an expertise in Corporate, International and Indirect Taxation matters. He believes in the mantra that “if you know why, you know how”. He is known for conceptual teaching along with problem solving in class for better presentation of answers in exams. At the same time he summarises the entire subject through charts for last day revision and preparing for the exam day through mock tests. His students have been All India Rank holders and best paper awardees in Direct and Indirect Taxes. His students are preferred in Big Four as his teaching is more contemporary, suited to the present dynamic scenario. He is the only faculty in India of repute to teach Direct as well as Indirect Taxation at CA Final & I PCC level.