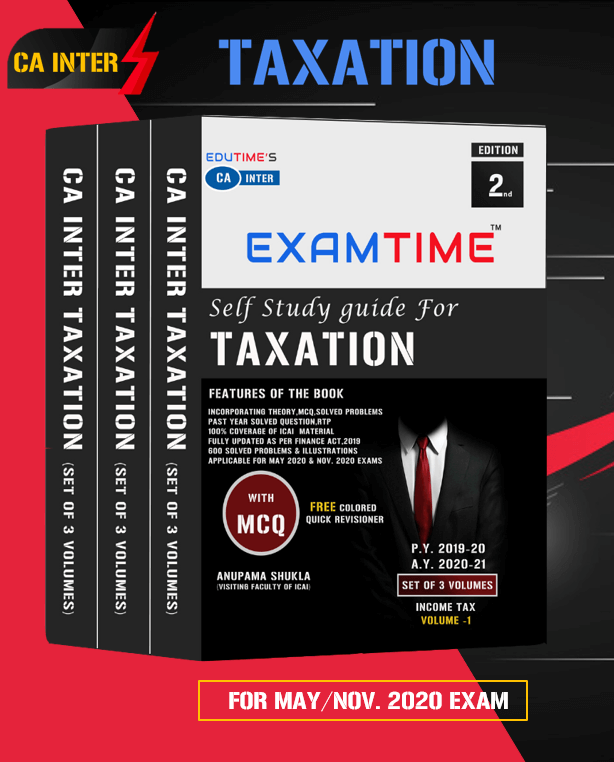

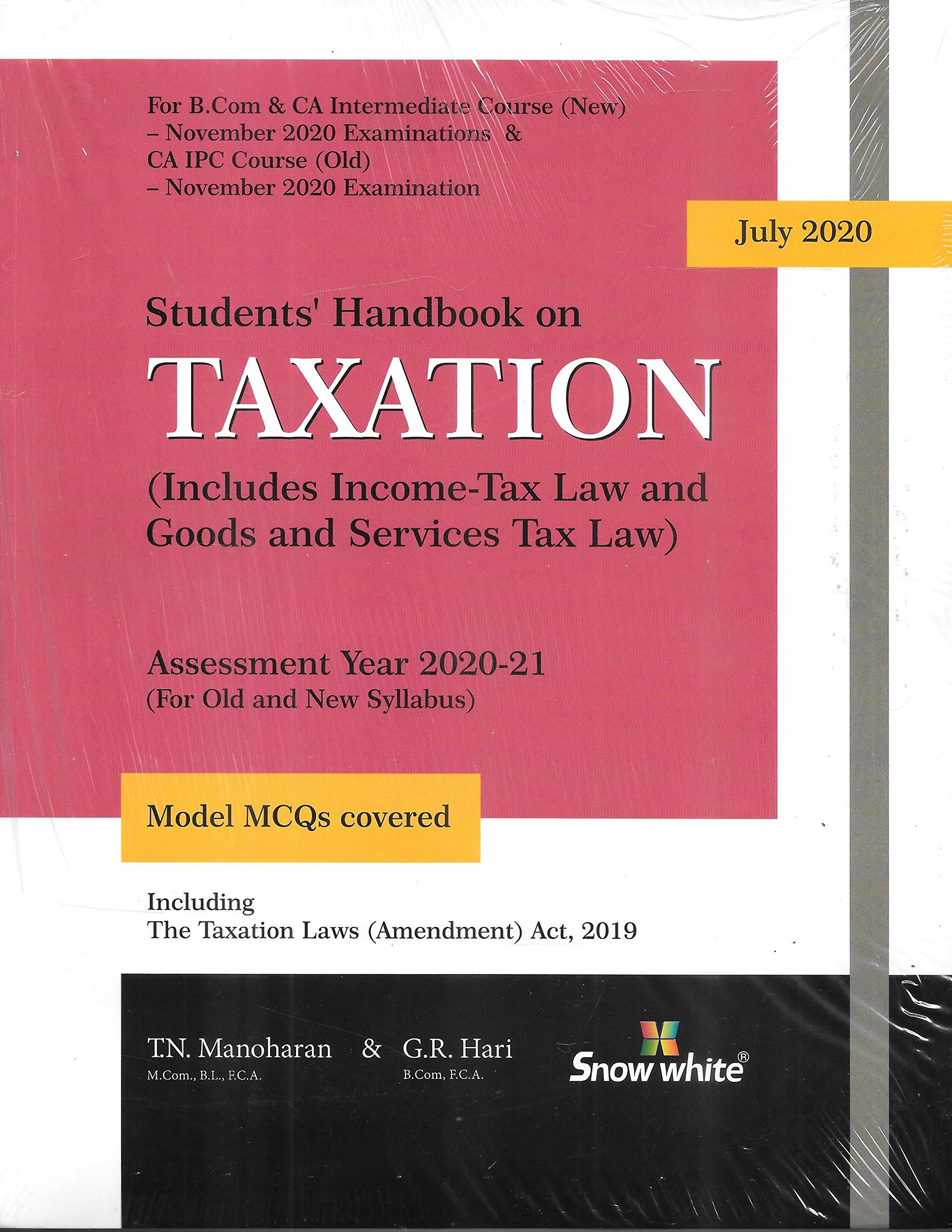

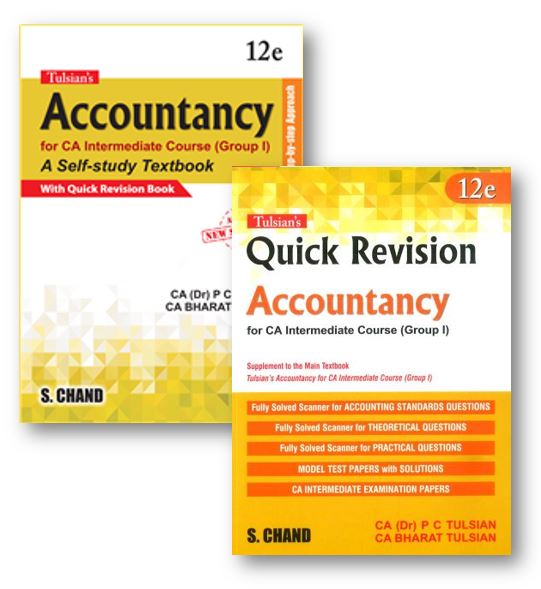

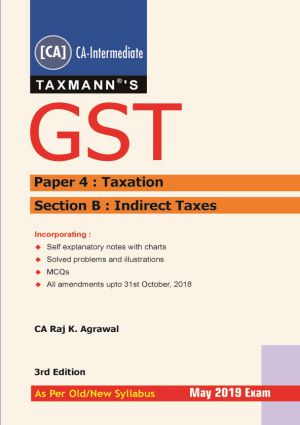

Ca vijender aggarwal taxation for May 2020 & Nov. 2020(income tax and GST ) set of 3 Book for ca inter

This Book is useful for CA IPCC students (old and New Syllabus) Appearing in May 2020 & Nov, 2020 Exams

Safe and Secure Payments. Easy returns. 100% Authentic products.

Safe and Secure Payments. Easy returns. 100% Authentic products.

|

- Cash on Delivery

- Next Day Delivery

-

Publication: IGP Publication

-

Cover: Paperback

-

Language: English

-

Edition: 8th

-

Useful For: CA Ipcc / CA Inter

Feature of The Book

This Edition comprehensively covers the Study Material, Practice Manual, RTPs, MTPs and any other supplementary material issued by the BOS of ICAI. Moreover, all relevant examination questions till May 2018 attempt have also been incorporated so that the students can maintain a meaningful focus on examination requirements while studying. The goal is to provide the students with the most updated and complete material so that they are not required to refer to any other material whatsoever.

The main emphasis of the material is to present an otherwise complicated subject in a simplified and reader-friendly manner so as to ignite an interest amongst the students for this subject. Conscious efforts have been made to keep the language of the material simple and crisp. The legal provisions have been duly supported by examples to illustrate the real-time application of the subject.

In order to ensure quick revision, the points which need to be revised at the last moment have been highlighted in “red” font. Moreover, the legal provisions have been printed in a single-sided mode so that the students can make use of the available blank page to make their own notes, summaries and flowcharts in this material itself.

Contents -

Income Tax

1. Computation Of Total Income & Tax Liability

2. Taxation Of Gift [Section 56(2)(x)]

3. Taxation Of Dividends

4. Income From House Property (Sections 22 to 27)

5. Residential Status & Scope Of Total Income (Sections 5 to 9)

6. Agricultural Income

7. Set-off & Carry-Forward of Losses (Sections 70 to 80)

8. Clubbing of Income (Sections 60 to 65)

9. Income From Other Sources (Sections 56 to 59)

10. Deductions From Gross Total Income (Sections 80C to 80U)

11. TDS (Sections 190 to 206AA)/TCS (Section 206C)

12. Filing of Return of Income (Section 139 to Section 140)

13. Advance Tax (Sections 207 to 219)

14. Profits & Gains of Business/ Profession (Sections 28 to 44DB)

15. Income From Capital Gains (Sections 45 to 55A)

16. Income From Salary (Sections 15 to 17)

17. Miscellaneous Topics

Goods and Service Tax

1. Introduction to GST

2. Change of GST

3. Supply under GST

4. Composition Scheme

5. Time of Supply

6. Value of Supply

7. Input Tax Credit

8. Exemptions under GST

9. Registration

10.Documentation under GST

11. Payment of GST

13. Returns

ABOUT THE AUTHOR

ACADEMIC CREDENTIALS:

Vijender Aggarwal pursued his graduation in B.Com (Hons) from Shri Ram College of Commerce, Delhi University. His academic credentials include scoring 91% marks at CA-CPT level and securing All India Rank 1 at both CA-IPCC level and CA Final level, a feat rarely matched in the field of Chartered Accountancy. He also added another feather in his cap by scoring 92% marks in “Paper 4: Taxation” at CA-IPCC level which apparently was the highest score Pan-India in Taxation paper in CA-IPCC Nov 2010 attempt and for which he was awarded the ‘Best Paper Award’ by ICAI. He has also been awarded the ‘Best Paper Award' by ICAI for his meritorious performance in “Paper 5: Advanced Management Accounting” and “Paper 8: Indirect Taxes” at CA-Final level.

ARTICLESHIP TRAINING DETAILS:

During his articleship stint at BMR Advisors (one of the best tax consultancy firms in India and now a part of Deloitte Touche Tohmatsu India, one of the Big4s), he gathered an invaluable experience of advising multinational and domestic clients across all areas of taxation, ranging from advisory and transaction structuring to compliances and litigation. The quality of his practical knowledge and experience can be easily judged by the enormous size of the clients that he got to work for at BMR Advisors, namely, Google, ITC, Network18 Group, Discovery Group, LG Group, Maruti Suzuki, MakeMyTrip, Yatra, Petronet LNG, Shell, Dassault Aviation, General Electric (‘GE') and many more.

POST-QUALIFICATION JOURNEY:

After an amazing end to his academic career, he has jumped back into the academic arena as a professional educationist with a motto to turn young bright aspirants into smart professionals. His style of teaching the subject with the help of PPTs, videos, using mnemonics for ease of memorizing multiple points and summarizing lengthy topics into concise flowcharts has been hailed by his students as it not only makes the subject simple and interesting but also easy to revise at the time of preparation for tests and exams. Besides teaching, he is also engaged in providing tax-consultancy across all areas of direct taxes, GST and international taxation to numerous clients on a freelancer basis.