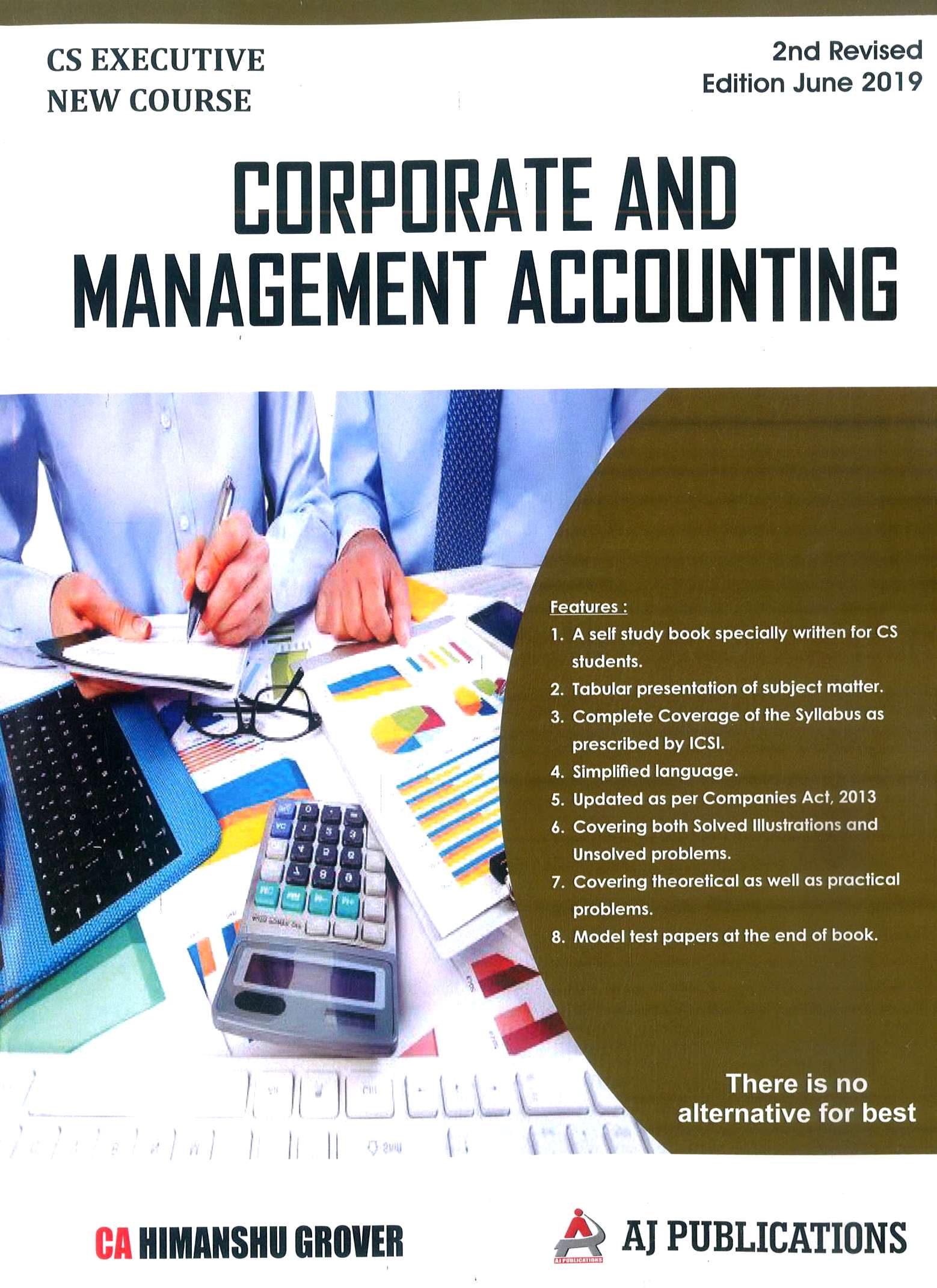

CS Executive Tax Laws New Syllabus For Dec. 2019 By Himanshu Grover

This Book is useful cs executive students appearing in Dec. 2019 Exam

₹850

₹715

Safe and Secure Payments. Easy returns. 100% Authentic products.

Safe and Secure Payments. Easy returns. 100% Authentic products.

|

HAVE QUERIES? GET QUICK HELP

CHECK CASH ON DELIVERY AND NEXT DAY DELIVERY AT YOUR LOCATION:

- Cash on Delivery

- Next Day Delivery

Customers who bought this item also bought:

General Information:

-

Publication: Aj Publication

-

Cover: Paperback

-

Language: English

-

Number of Pages: 476

-

Edition: 2nd Edition, 2018

-

Useful For: CS Executive and other specialize courses

Features

Tabular presentation of subject matter

More than 3300 Multiple Choice Questions

Solved June 2019 Question Paper at the end of book

Self Study & Exam Oriented Approach

Updated as per Finance Act, 2018

.

Contents

Part A: Direct Tax (50 Marks)

Direct Taxes – at a Glance

Important Definitions & Tax Rates

Residential Status and Scope of Total Income

Incomes Which Do Not Form Part of Total Income

Computation of Agricultural Income

Income Under the Head Salaries

Income Under the Head House Property

Profit and Gains from Business or Profession

Income from Capital Gains

Income from Other Sources

Clubbing of Income

Set Off & Carry Forward of Losses

Deductions from Gross Total Income

Computation of Total Income & Tax Liability of Individuals

Computation of Total Income & Tax Liability of HUF

Computation of Total Income & Tax Liability of Firm & LLP

Classification and Tax Incidence on Companies

Procedural Compliance TDS, TCS & Advance Tax

Procedural Compliance Return of Income

Assessment, Appeals & Revision

Part B: Indirect Tax (50 Marks)

Concept of Indirect Taxes at a Glance

Levy and Collection of Tax

Concept of Time, Value and Place of Taxable Supply

Input Tax Credit

Computation of GST Liability & Payment of Tax

Registration Under GST

Tax Invoice, Credit and Debit Notes

Accounts and Audit

E Way Bills

Returns

Refunds

The Integrated Goods and Services Tax Act, 2017

The Union Territory Goods and Services Tax Act 2017

GST Compensation to States Act

Overview of Customs Law

Question Paper – June 19