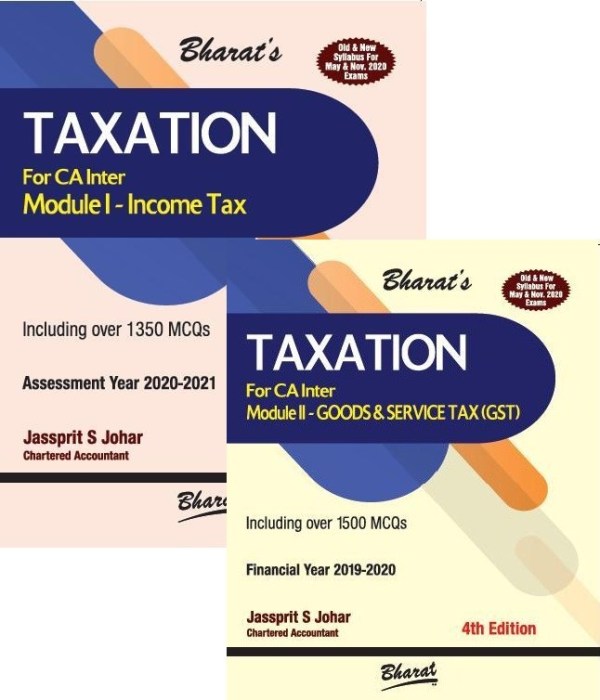

CA Inter Taxation (Set of 2 Module )For May/Nov. 2020 By Jassprit S Johar

Module I - Income Tax Including MCQs , Module II - Goods and Services Tax ,This Book is useful for CA Inter / CMA Inter , New & Old Syllabus students Appearing in May/Nov. 2020 Exam

Safe and Secure Payments. Easy returns. 100% Authentic products.

Safe and Secure Payments. Easy returns. 100% Authentic products.

|

- Cash on Delivery

- Next Day Delivery

-

Publication: Bharat

-

Cover: Paperback

-

Language: English

-

ISBN Number: 9789386920249, 9789386920263

-

Number of Pages: 1105

-

Edition: 4th,

-

Useful For: CA Inter / CMA Inter

About TAXATION (Module-I: INCOME TAX)

Including Over 1350 MCQs

Chapter 1 Introduction, Basic Concepts and Definitions under Income Tax Act, 1961

MCQs from Introduction and Definitions

Chapter 2 Residential Status & Tax Incidence

MCQs

Chapter 3 Concept & Calculation of Income Tax

MCQs

Chapter 4 Agricultural Income & Its Tax Treatment

MCQs

Chapter 5 Income under the Head Salary

MCQs

Chapter 6 Income under Head House Property

MCQs

Chapter 7 Income under the Head ‘Profits and Gains from Business and Profession’ (PGBP)

MCQs of PGBP

Chapter 8 Income under the Head ‘Capital Gains’

MCQs on Capital Gains

Chapter 9 Income under the Head ‘Other Sources’

MCQs

Chapter 10 Clubbing of Incomes

MCQs

Chapter 11 Set Off of Losses and Carry Forward of Losses

MCQs of the Chapter of Treatment of Losses

Chapter 12 Deductions from Gross Total Income (Chapter VIA of Income Tax Act, 1961)

MCQs from Chapter of Deductions

Chapter 13 Incomes which are Exempt from Income Tax

MCQs of Exempted Incomes

Chapter 14 Procedure of Filing of Income Tax Returns

MCQs of Income Tax Return

Chapter 15 Tax Deducted at Source

MCQs on TDS

Chapter 16 Advance Payment of Tax and Interest Payable by Assessee

MCQs on Advance Payment of Tax

Chapter 17 Assessment of Individuals

About TAXATION (Module-II: GST)

Including Over 1500 MCQs

Chapter 1 Basic Introduction to Goods and Services Tax (GST)

Examination Questions

MCQs [Please see end of Chapter 2]

Chapter 2 Chargeability under CGST and IGST

MCQs

Chapter 3 Supply under GST

Examination Questions

MCQs

Chapter 4 Exemptions under GST

Examination Questions

MCQs

Chapter 5 Value of Supply under GST

Examination Questions

MCQs

Chapter 6 Composition Scheme

Examination Questions

MCQs

Chapter 7 Time of Supply Under GST

Examination Questions

MCQs

Chapter 8 Input Tax Credit under GST (Sections 16, 17, 18)

Examination Questions

MCQs

Chapter 9 Payment of GST (Sections 49, 50 and Rules 85, 86, 87, 88)

Examination Questions

MCQs

Chapter 10 Registration under GST (Section 22 to 30)

Annexure State Codes for GSTIN

MCQs

Chapter 11 Invoice under GST (Section 31 to 34 of CGST Act, 2017 & Section 20 of IGST Act, 2017 Tax Invoice, Credit and Debit Notes of CGST Rules, 2017)

Examination Questions

MCQs

Chapter 12 Provisions Relating To E-Way Bill: Rule 138

MCQs

Chapter 13 Filing of Return under GST (Section 37 to 48 of CGST Act, 2017-Rules 59 to 84 of CGST Rules, 2017)

Examination Questions

MCQs