CA Final Combo GST Summary Book and Custom Summary Book Include Question Bank For Nov. 2019 By Manoj Batra

This Book is useful for CA Final Nov. 2019 Exam .

Safe and Secure Payments. Easy returns. 100% Authentic products.

Safe and Secure Payments. Easy returns. 100% Authentic products.

|

- Cash on Delivery

- Next Day Delivery

-

Publication: Pooja Law House

-

Cover: Paperback

-

Language: English

-

Edition: 2018

-

Useful For: CA Final

GST Summary Book For CA Final By CA Manoj Batra

PART-1

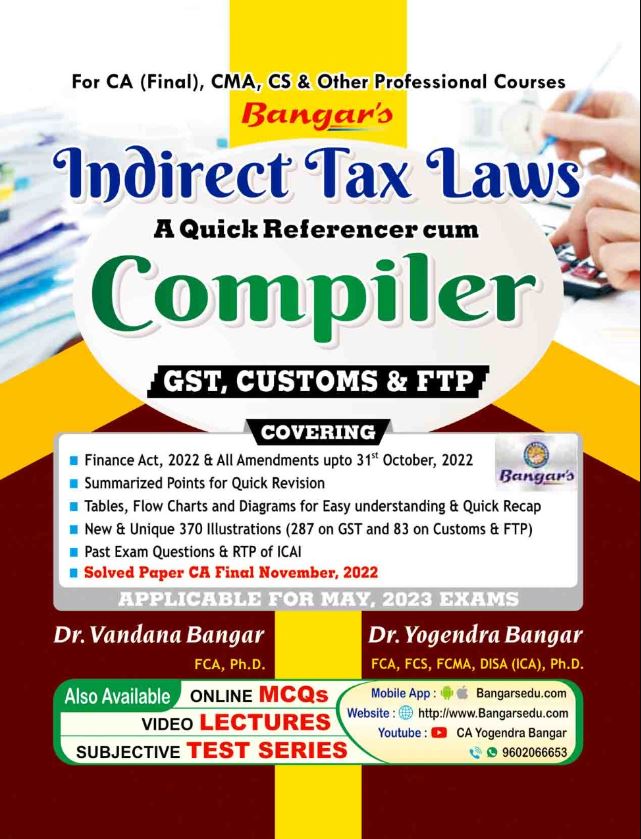

1. Basic of GST

2. Definition

3. Administration

4. Levy and collection, composition, reverse charge

5. Place of supply

6. Time and value of supply

7. Registration

8. Input tax credit

9. Tax invoice, Credit and Debit note

10. Accounts and records

11. Returns

12. Payment of tax, Tax deduction at source, Tax collection at source

PART-2

13. Exemption

14. Rates on services and services GST

15. Classification with rates of GST

16. Assessment and audit

17. Refunds,

18. Export and import

19. Inspection, search, seizure and arrest

20. Offences and penalty

21. Demands and recovery

22. Liability to pay in certain cases

23. Advance ruling

24. Appeals and revision

25. Transitional provision

26. Miscellaneous

CA Final IDT ( GST ) Customs Summary By Manoj Batra

Contents -

1. Definition

2. Import–export procedure

3. Transit, transshipment

4. Basic concept

5. Type of duties

6. Valuation

7. Warehousing

8. Duty Drawback

9. Coastal goods

10. Stores

11. Import or export by post

12. Baggage

13. Classification

Demand and recovery, Refund

Appeals

Advance Ruling, Settlement

Commission

Search, seizure, misc

About the Author

CA Manoj Batra, Indirect Taxes (Final) is a Dynamic Chartered Accountant. He was placed in Merit list of ICAI (Rankholder). His teaching style is awesome and teaches through hi-tech technology and audio- visual techniques He has made a complex CA FINAL INDIRECT TAX subject very interesting and simple. His way of teaching methodology targeted to understand intricate provisions of law with the illustration and practical knowledge of the Industry. His Fantastic Approach towards the subject creates interest in the subject and his students always produce best Results. He has been a visiting faculty of ICAI and having very rich experience of teaching students and delivered number of seminars on Indirect Taxation.