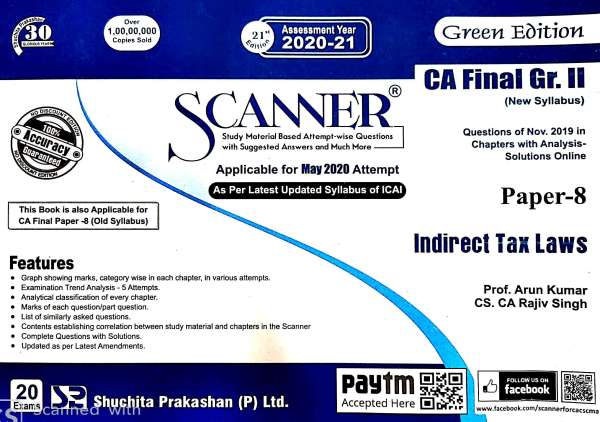

CA final Shuchita Prakashan Solved Scanner Indirect Tax Laws for May 2020 By Prof. Arun Kumar and Rajiv Singh

Group-II Paper 8 , This Book is useful for CA final New Syllabus for May 2020 Exam

₹350

Safe and Secure Payments. Easy returns. 100% Authentic products.

Safe and Secure Payments. Easy returns. 100% Authentic products.

|

HAVE QUERIES? GET QUICK HELP

CHECK CASH ON DELIVERY AND NEXT DAY DELIVERY AT YOUR LOCATION:

- Cash on Delivery

- Next Day Delivery

General Information:

-

Publication: Shuchita Prakashan

-

Cover: Paperback

-

Language: English

-

ISBN Number: 9789389323498

-

Edition: 21st

-

Useful For: CA Final New Syllabus

Graph showing marks, category wise in each chapter, in various attempts.

Examination Trend Analysis – 5 attempts.

Analytical classification of every chapter.

Marks of each question/part question.

List of similarly asked questions.

Contents establishing correlation between study material and chapters in Solved Scanner.

Complete Questions with Solutions.

Contents

Part I : Goods and Services Tax

Study Material Based Contents

Syllabus

1. GST in India – An Introduction

2. Supply Under GST

3. Charge of GST

4. Exemptions from GST

5. Place of Supply

6. Time of Supply

7. Value of Supply

8. Input Tax Credit

9. Registration

10. Tax Invoice, Credit and Debit Notes

11. Accounts and Records

12. Payment of Tax

13. Returns

14. Refunds

15. Job Work

16. Electronic Commence

17. Assessment and Audit

18. Inspection, Search, Seizure and Arrest

19. Demands and Recovery

20. Liability to Pay Tax in Certain Cases

21. Offences and Penalties

22. Appeals and Revision

23. Advance Ruling

24. Miscellaneous Provisions

25. Transitional Provisions

Part II : Customs & FTP

Study Material Based Contents

Syllabus

Examination Trend Analysis

Line Chart Showing Relative Importance of Chapters

Table Showing Importance of Chapter on the Basis of Marks

Table Showing Importance of Chapter on the Basis of Marks of Compulsory Question

Legends for the Graphs

1. Levy of and Exemptions from Customs Duty

2. Types of Duty

3. Classification of Imported and Export Goods

4. Valuation under the Customs Act, 1962

5. Importation, Exportation and Transaction of Goods

6. Warehousing

7. Duty Drawback

8. Demand and Recovery

9. Refund

10. Provisions Relating to Illegal Import, Illegal Export, Confiscation,

Penalty & Allied Provisions

11. Appeals and Revision

12. Settlement Commission

13. Advance Ruling

14. Miscellaneous Provisions

15. Foreign Trade Policy.