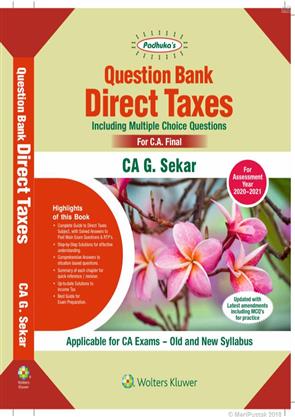

Question Bank on Direct Taxes with Solutions Old and New Syllabus For CA Final By CA G Sekar

This Book is useful for CA Final students (Old & New Syllabus) Appearing in May 2020 Exam and onward.

Safe and Secure Payments. Easy returns. 100% Authentic products.

Safe and Secure Payments. Easy returns. 100% Authentic products.

|

- Cash on Delivery

- Next Day Delivery

-

Publication: Padhuka

-

Cover: Paperback

-

Language: English

-

ISBN Number: 9789389702323

-

Edition: 4th Edition 2020

-

Useful For: CA Final

Highlights of this Book -

Complete Guide to Direct Taxes Subject, with Solved Answers to Past Main Exam Questions

Step-by-Step Solutions for effective understanding.

Comprehensive Answers to situation based questions.

Up-to-date solutions to Income Tax

Chapter wise segregation of Questions

Best Guide for Exam Preparation

Contents -

Basic Concepts in Income Tax Law

Residential Status and Taxability in India

Exemptions under Income Tax Act

Income from Salaries

Income from House Property

Profits and Gains of Business or Profession

Capital Gains

income from Other Sources

Income of other persons included in Assessee’s ‘total Income

set- off and Carry Forward of Losses

Deductions under Chapter VI-A

Rebate & Relief

Agricultural Income

tax Planning & Ethics in Taxation

Taxation of Individuals

Taxation of HUF

‘Taxation of Partnership Firm

Taxation of Limited Liability Partnerships

Taxation of Companies

Presumptive ‘Taxation of Shipping Companies – Tonnage Tax Scherne

Taxation of Co-operative Societies

Taxation of Association of Persons

Assessment of Charitable ‘trusts

Taxation of Persons – Others

Miscellaneous

Taxation of Non-Residents

Taxation of International Transactions

Double Taxation Avoidance Agreements

Income Computation & Disclosure Standards

Income Tax Authorities

Assessment Procedure – Duties of Assessee

Assessment Procedure – Powers of the Department

Assessment Procedure – Various Assessments

Assessment Procedure ~ Income Escaping Assessment

Assessment Procedure – Search Assessment

Liability in Special Cases

Settlement Commission

Rectification and Revision

Appeals to Various Authorities

Authority for Advance Rulings

Tax Deducted at Source

Advance Tax, Collection and Recovery of Tax

Interest

Refunds

Penalties and Prosecutions