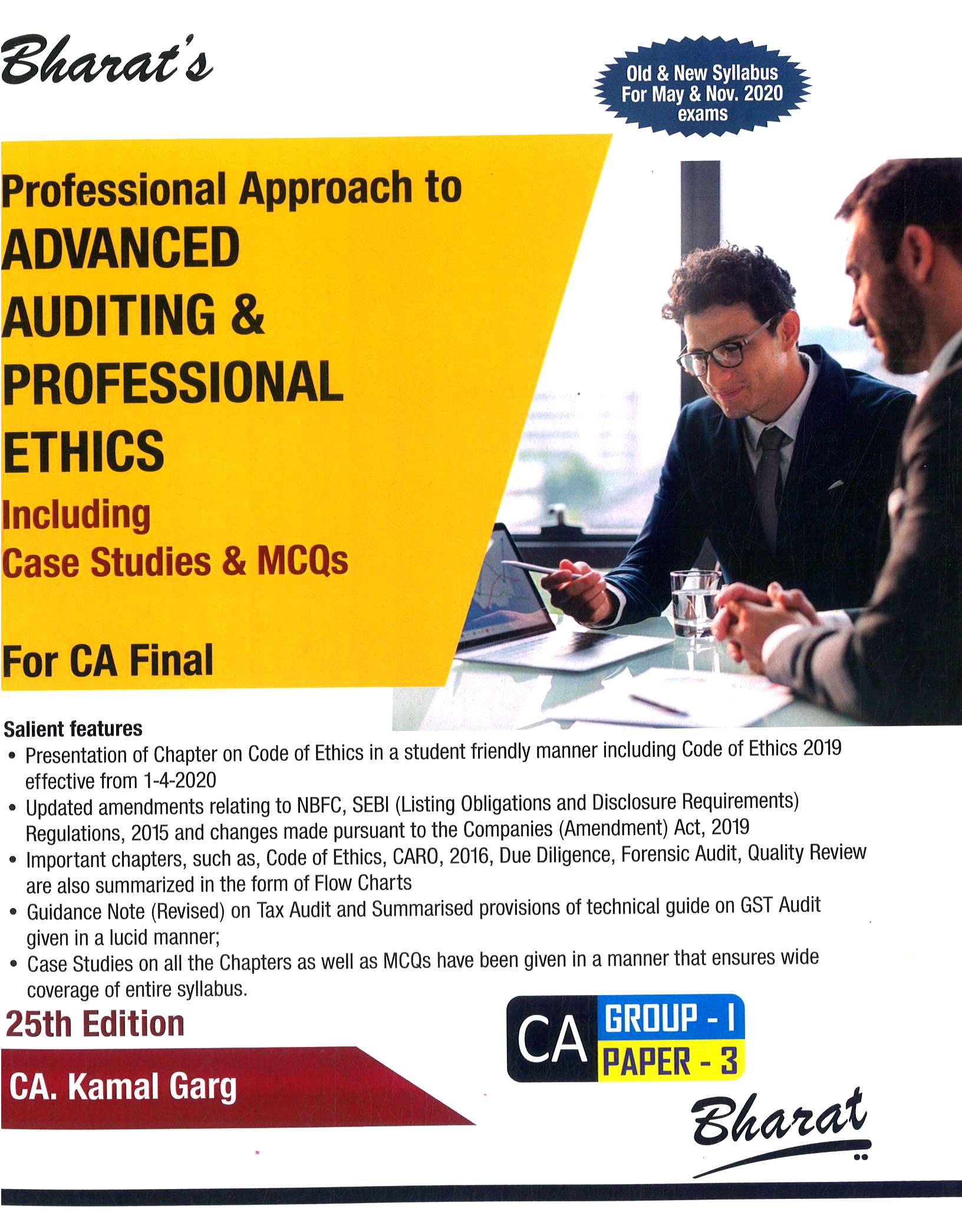

CA Final Professional Approach to Advanced Auditing & Professional Ethics For May 2020 By CA. Kamal Garg

This Book is useful for CA Final students Old and New Syllabus Appearing in May/Nov. 2020 Exam and onward.

₹1,095

₹970

Safe and Secure Payments. Easy returns. 100% Authentic products.

Safe and Secure Payments. Easy returns. 100% Authentic products.

|

HAVE QUERIES? GET QUICK HELP

CHECK CASH ON DELIVERY AND NEXT DAY DELIVERY AT YOUR LOCATION:

- Cash on Delivery

- Next Day Delivery

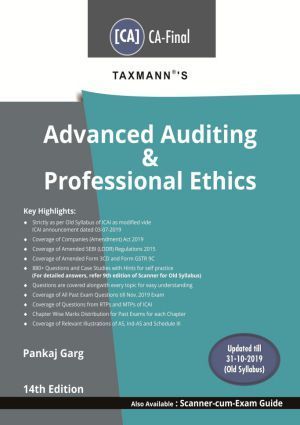

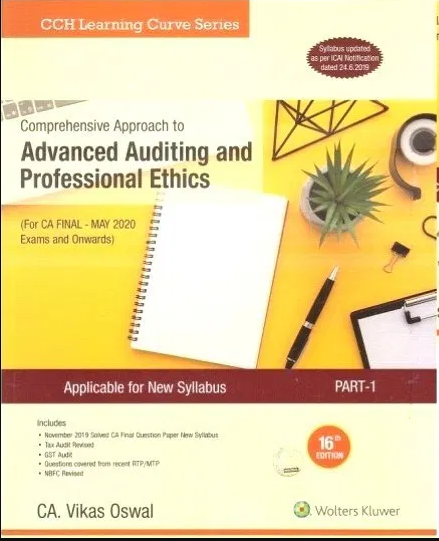

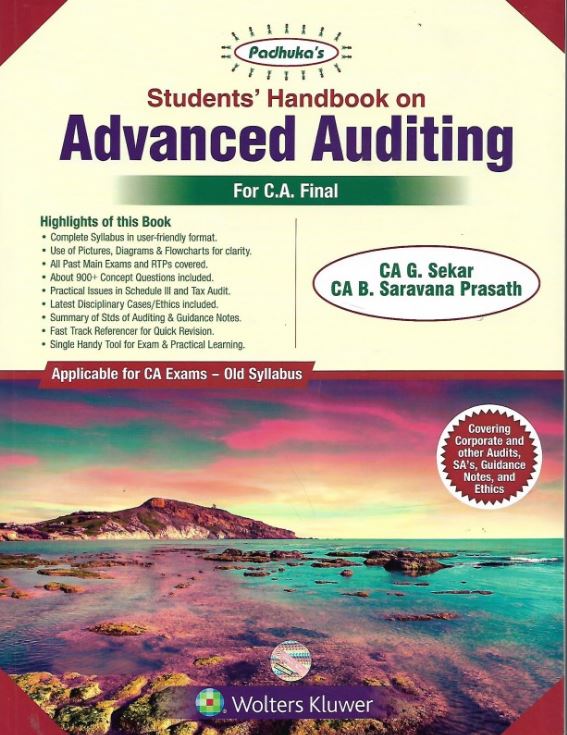

Customers who bought this item also bought:

General Information:

-

Publication: Bharat

-

Cover: Paperback

-

Language: English

-

ISBN Number: 9789386920409

-

Edition: 25th, 2020

-

Useful For: Ca Final

Salient features

Presentation of Chapter on Code of Ethics in a student friendly manner including Code of Ethics 2019 effective from 1-4-2020

Updated amendments relating to NBFC, SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 and changes made pursuant to the Companies (Amendment) Act, 2019

Important chapters, such as, Code of Ethics, CARD, 2016, Due Diligence, Forensic Audit, Quality Review are also summarized in the form of Flow Charts

Guidance Note (Revised) on Tax Audit and Summarised provisions of technical guide on GST Audit given in a lucid manner;

Case Studies on all the Chapters as well as MCQs have been given in a manner that ensures wide coverage of entire syllabus.

Contents -

Chapter 1 Declaration of Dividend

Chapter 2 Interim Dividend

Chapter 3 Final Dividend

Chapter 4 Transfer of Unpaid Dividend to the Investor Education and Protection Fund

Chapter 5 Maintenance of Books of Accounts and Consolidation of Financial Statements

Chapter 6 Directors’ Report

Chapter 7 Corporate Social Responsibility

Chapter 8 Internal Audit

Chapter 9 Appointment, Change, Powers and Duties of the Auditors

Chapter 10 Cost Audit I

Chapter 11 Auditor’s Report

Chapter 12 Branch Audit

Chapter 13 The Company Audit and Audit of Limited Liability Partnerships

Chapter 14 Code of Ethics

Chapter 15 Liabilities of Auditors

Chapter 16 Audit under Fiscal Laws

Chapter 17 Cost Audit II

Chapter 18 Management and Operational Audit

Chapter 19 EDP Audit

Chapter 20 Audit of Public Sector Undertakings

Chapter 21 Investigations, Due Diligence and Forensic Audit

Chapter 22 Companies (Auditor’s Report) Order, 2016 (CARO, 2016)

Chapter 23 Audit of Banks

Chapter 24 Audit of Insurance Companies

Chapter 25 Audit of Non-Banking Financial Companies

Chapter 26 Audit of Co-Operative Societies

Chapter 27 Audit of Indirect Taxes

Chapter 28 Audit Committee and Corporate Governance

Chapter 29 Peer Review

Chapter 30 Standards on Auditing

Chapter 31 Guidance Notes on Auditing Aspects

Chapter 32 Standards on Quality Control and Assurance Engagements

Chapter 33 Standard on Quality Control (SQC) 1

APPENDIX I

FORMATS UNDER SA

1 Case Studies

2 Multiple Choice Questions (MCQs)

MCQs 1

MCQs 2

MCQs 3

MCQs 4

MCQs 5