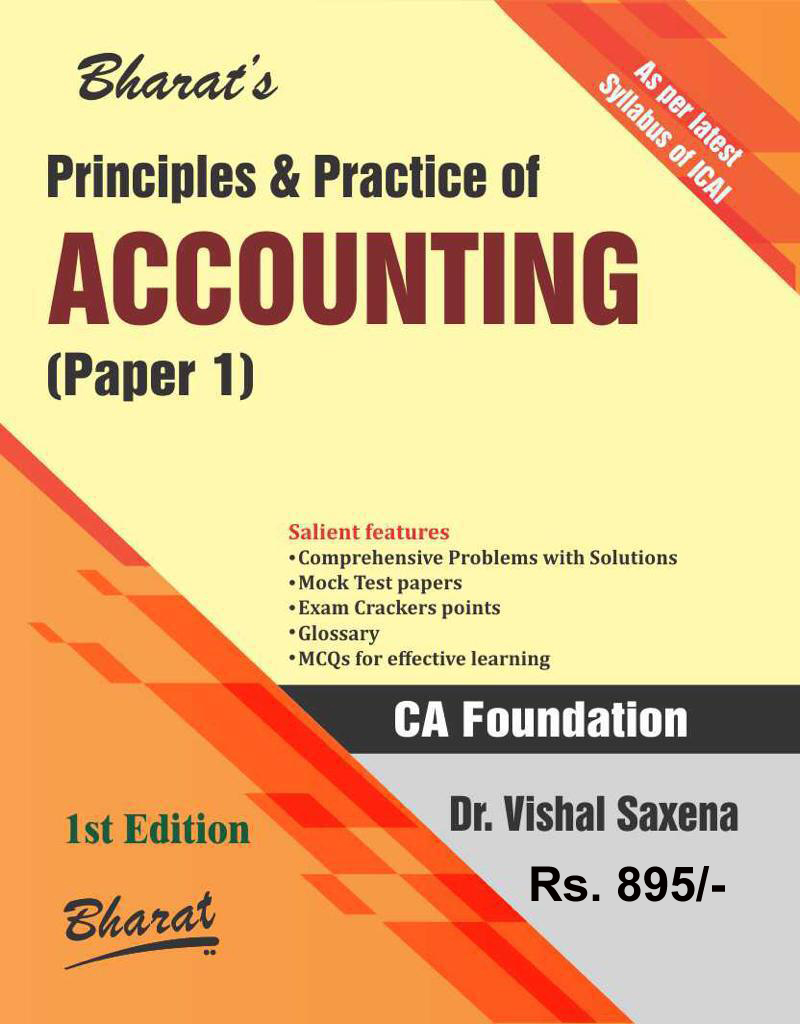

PRINCIPLES AND PRACTICE OF ACCOUNTING (For CA Foundation) by Dr. VISHAL SAXENA

This Book is useful for CA Foundation students of ICAI Appearing in June 2019 Exam and onward.

Safe and Secure Payments. Easy returns. 100% Authentic products.

Safe and Secure Payments. Easy returns. 100% Authentic products.

|

- Cash on Delivery

- Next Day Delivery

-

Publication: Bharat

-

Cover: Paperback

-

Language: English

-

ISBN Number: 9789351396376

-

Number of Pages: 812

-

Edition: 1st edn., 2018

-

Useful For: CA Foundation ,Also useful for CS & CMA

About PRINCIPLES AND PRACTICE OF ACCOUNTING (For CA Foundation) Also useful for CS & CMA

Chapter 1 Accounting: An Introduction

Chapter 2 Accounting Principles: Concepts and Conventions

Chapter 3 Accounting Standards: Indian and International

Chapter 4 Double Entry System

Chapter 5 Journal, Ledger and Trial Balance

Chapter 6 Cash Book and other Subsidiary Books

Chapter 7 Rectification of Errors

Chapter 8 Bank Reconciliation Statement

Chapter 9 Inventory Valuation

Chapter 10 Depreciation Accounting

Chapter 11 Bills of Exchange

Chapter 12 Sale of Goods on Approval Basis

Chapter 13 Consignment Accounts

Chapter 14 Joint Venture Accounts

Chapter 15 Royalty Accounts

Chapter 16 Average Due Date and Account Current

Chapter 17 Final Accounts

Chapter 18 Partnership: Introduction and Nature

Chapter 19 Partnership: Final Accounts and Goodwill

Chapter 20 Partnership: Admission of a New Partner

Chapter 21 Partnership: Retirement or Death of A Partner

Chapter 22 Financial Statements of Not-for-Profit Organisations

Chapter 23 Issue and Forfeiture of Shares

Chapter 24 Issue of Debentures

Chapter 25 Ratio Analysis

Multiple Choice Questions (MCQs)

Mock Test (with Solution) Paper-1

Mock Test (with Solution) Paper-2

Glossary