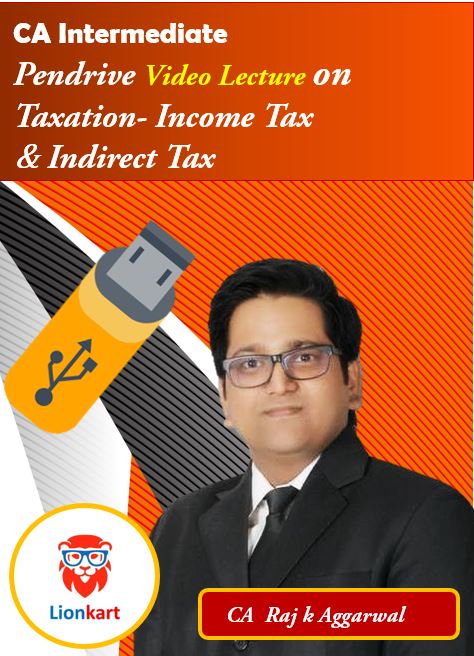

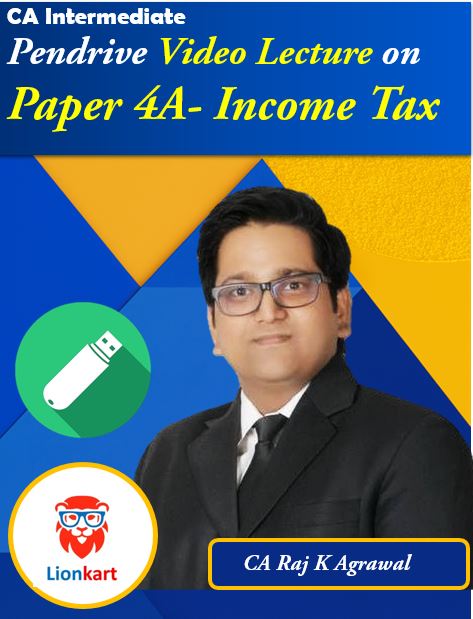

Paper 4 - Taxation- Income Tax & Indirect Tax Video Lecture By CA Raj K Agrawal

AY 2019-20 ,This video lecture is useful for CA Inter / Ipcc Group I students Appearing in May / Nov, 2019 Exam.

Safe and Secure Payments. Easy returns. 100% Authentic products.

Safe and Secure Payments. Easy returns. 100% Authentic products.

|

- Cash on Delivery

- Next Day Delivery

-

Format: USB / Pen Drive

-

Video Language: Hindi

-

Course Material Language: English

-

Video Runs On: Computer Laptop

-

Study Material Format: Printed Books

-

Doubt Solving Facility: Email Support

-

Duration: 151 Hours , Number of Lecture -130

-

Validity: Till May 2019

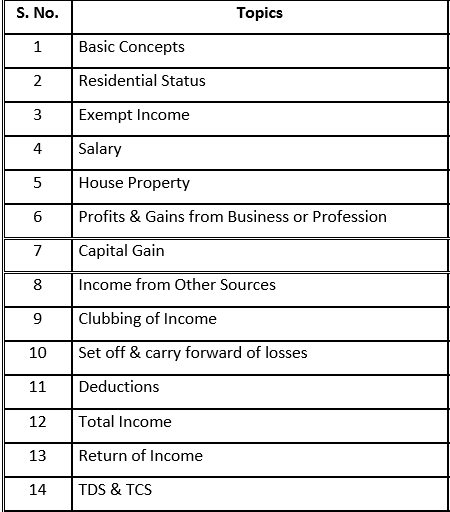

Topics -

1 Basic Concepts

2 Residential Status

3 Exempt Income

4 Salary

5 House Property

6 Profits & Gains from Business or Profession

7 Capital Gain

8 Income from Other Sources

9 Clubbing of Income

10 Set off & carry forward of losses

11 Deductions

12 Total Income

13 Return of Income

14 TDS & TCS

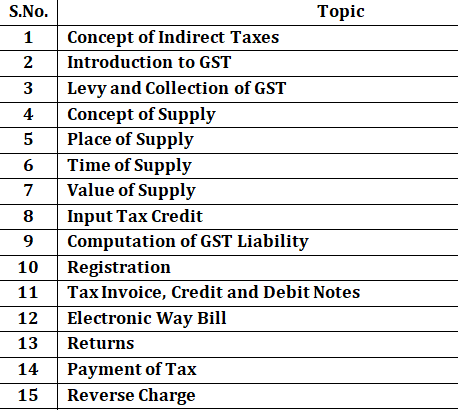

Topics -

1 Concept of Indirect Taxes

2 Introduction to GST

3 Levy and Collection of GST

4 Concept of Supply

5 Place of Supply

6 Time of Supply

7 Value of Supply

8 Input Tax Credit

9 Computation of GST Liability

10 Registration

11 Tax Invoice, Credit and Debit Notes

12 Electronic Way Bill

13 Returns

14 Payment of Tax

15 Reverse Charge

Raj K Agrawal, qualified Chartered Accountancy with all India 27th rank in CA Final and all India 29th rank in CA PE-I. He has been a consistent school and college topper.He is endowed with the passion of winning as evidenced through demonstrated excellence in Academics and Teaching Career. He is Educator of a renowned commerce coaching class at Varanasi. He has authored several books for professional courses. His primary focus is on enhancing student’s knowledge theoretically and practically as well as focused preparations to ensure success in the examinations and to achieve professional expertise.