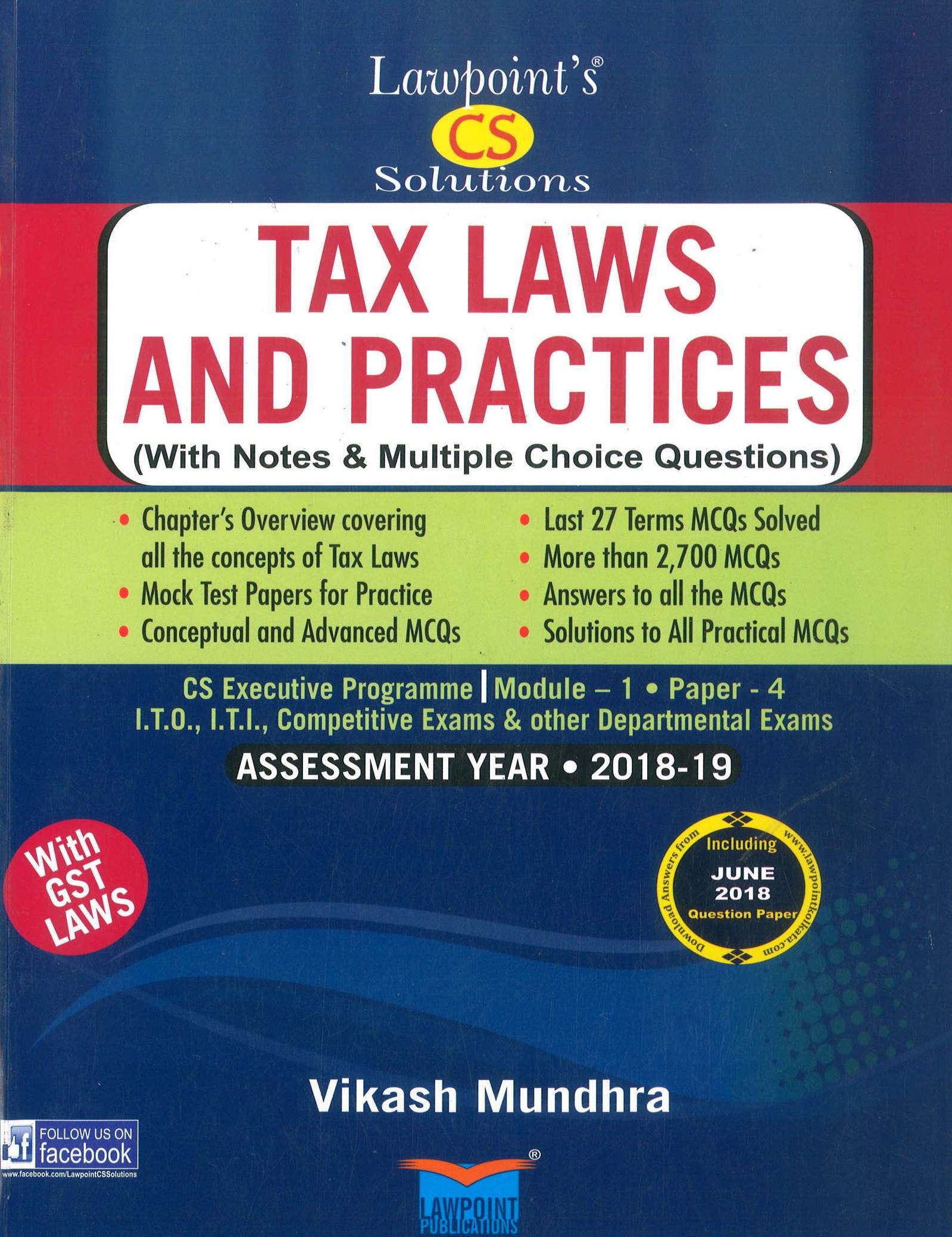

Lawpoint CS Solutions Tax Laws and Practices By Vikash Mundhra

With Notes & Multiple Choice Questions , This Book is useful for cs Executive students Appearing in Dec, 2018 Exam

Safe and Secure Payments. Easy returns. 100% Authentic products.

Safe and Secure Payments. Easy returns. 100% Authentic products.

|

- Cash on Delivery

- Next Day Delivery

-

Cover: Paperback

-

Language: English

-

ISBN Number: 9789386185655

-

Edition: 2018

-

Useful For: CS Executive

Chapter’s Overview covering all the concepts of Tax Laws

Mock Test Papers for Practice

Conceptual and Advanced MCQs

Last 26 Terms MCQs Solved

More than 2,700 MCQs

Answers to all the MCQs

Solutions to all Practical MCQs

CONTENTS :-

1 INTRODUCTION AND IMPORTANT DEFINITIONS

2 BASIS OF CHARGE, SCOPE OF TOTAL INCOME AND RESIDENTIAL STATUS

3 INCOME WHICH DO NOT FORM PART OF TOTAL INCOME

- INCOME EXEMPT FROM TAX

- AGRICULTURAL INCOME

4 COMPUTATION OF TOTAL INCOME UNDER VARIOUS HEADS

- INCOME UNDER THE HEAD SALARIES

- INCOME UNDER THE HEAD HOUSE PROPERTY

- INCOME FROM BUSINESS OF PROPERTY

- INCOME FROM CAPITAL GAINS

- INCOME FROM OTHER SOURCES

5 INCOME OF OTHER PERSONS INCLUDED ASSESSEE'S TOTAL INCOME SET-OFF & CARRY FORWARD OF LOSSES

- CLUBBING OF INCOME

- SET OFF & CARRY FORWARD OF LOSSES

6 DEDUCTION FROM TOTAL INCOME

7 COMPUTATION OF TAX LIABILITY & TOTAL INCOME

- COMPUTATION OF TOTAL INCOME & TAX LIABILITY

- VARIOUS ENTITIES

8 COMPUTATION OF TAX LIABILITY OF COMPANIES

9 COMPUTATION OF TAX LIABILITY OF NON-RESIDENT ASSESSEES

10 COLLECTION & RECOVERY OF TAX

11 PROCEDURE FOR ASSESSMENT

12 APPEALS, REVISION, SETTLEMENT OF CASES AND PENALTIES & OFFENCES

13 TAX PLANNING & TAX MANAGEMENT

14 BASIC CONCEPTS OF INTERNATIONAL TAXATION

15 ADVANCE RULING AND GAAR

16 THE CENTRAL GOODS AND SERVICE TAX ACT 2017

17 THE INTEGRATED GOODS AND SERVICE TAX ACT 2017

18 THE UNION TERRITORY GOODS AND SERVICES TAX ACT 2017

19 THE GOODS AND SERVICES TAX ACT 2017