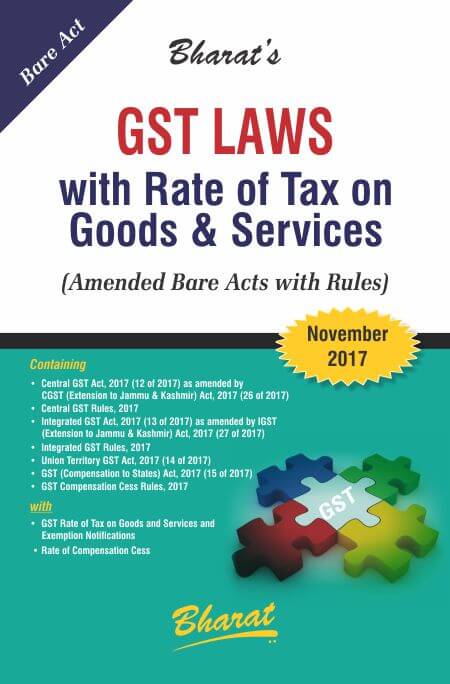

GST Laws with Rates of Tax on Goods and Services BY Bharat

This Book is useful for CA , CMA, cs professional students etc

Safe and Secure Payments. Easy returns. 100% Authentic products.

Safe and Secure Payments. Easy returns. 100% Authentic products.

|

- Cash on Delivery

- Next Day Delivery

-

Publication: Bharat

-

Cover: Paperback

-

Language: English

-

ISBN Number: 9789351395492

-

Number of Pages: 592

-

Edition: 2nd edn., November 2017

-

Useful For: corporate professionals CA CS CMA etc.

| About GST Laws with Rates of Tax on Goods & Services |

Part 1 Acts & Rules Chapter 1 The Central Goods and Services Tax Act, 2017 Chapter 2 Central Goods and Services Tax Rules, 2017 Chapter 3 The Integrated Goods and Services Tax Act, 2017 Chapter 4 The Integrated Goods and Services Tax Rules, 2017 Chapter 5 The Union Territory Goods and Services Tax Act, 2017 Chapter 6 The Goods and Services Tax (Compensation to States) Act, 2017 Chapter 7 Goods and Services Tax Compensation Cess Rules, 2017 Part 2 GST Rate of Tax on Goods and Services & Exemptions

Chapter 1 Consolidated Table of Rates of Taxes of Goods (including Exempt Goods) Chapter 2 Supplies of goods in respect of which no refund of unutilised input tax credit shall be allowed under section 54(3) Chapter 3 GST Rate of Tax on Services — Consolidated Table Chapter 4 GST Exemption Notification related to Services

Chapter 5 GST Compensation Cess on Goods and Services |