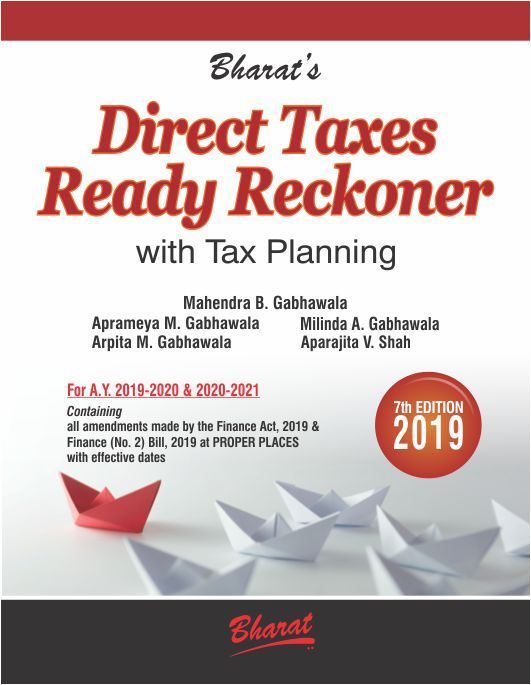

DIRECT TAXES READY RECKONER with Tax Planning By by Mahendra B Gabhawala

Edition 7th , 2019

₹1,195

₹1,015

Safe and Secure Payments. Easy returns. 100% Authentic products.

Safe and Secure Payments. Easy returns. 100% Authentic products.

|

HAVE QUERIES? GET QUICK HELP

CHECK CASH ON DELIVERY AND NEXT DAY DELIVERY AT YOUR LOCATION:

- Cash on Delivery

- Next Day Delivery

Customers who bought this item also bought:

General Information:

-

Publication: Bharat

-

Cover: Paperback

-

Language: English

-

ISBN Number: 9789351397182

-

Edition: 7th edn., 2019

-

Useful For: professionals

About DIRECT TAXES READY RECKONER with Tax Planning

Chapter 1 Significant Amendments made by Finance (No. 2) Bill, 2019 and Finance Act, 2019

Chapter 2 Guidelines for Online Submission

Chapter 3 Due Dates Calendar (Monthwise)

Chapter 4 Rates of Taxation

Chapter 5 Basic Concepts

Chapter 6 Tax Planning

Chapter 7 Exempt Income

Chapter 8 Taxation of Charity

Chapter 9 Salaries

Chapter 10 Income from House Property

Chapter 11 Profits and Gains of Business or Profession – PGBP

Chapter 12 Capital Gains

Chapter 13 Income from Other Sources

Chapter 14 Clubbing of Income

Chapter 15 Set off and Carry Forward of Losses

Chapter 16 Deductions and Rebates

Chapter 17 HUF, Firms, LLP, AOP and BOI

Chapter 18 Advance Tax and Self-assessment Tax

Chapter 19 TDS and TCS

Chapter 20 STT, CTT, DDT, MAT, AMT and CDT

Chapter 21 Amalgamation and Demerger

Chapter 22 NR, DTAA, Transfer Pricing, AAR and DRP

Chapter 23 Survey, Requisition, Search and Seizure

Chapter 24 Return of Income, PAN, TAN and AIR

Chapter 25 Assessment Procedure

Chapter 26 Post-Search Assessment

Chapter 27 Interest, Penalties and Prosecution

Chapter 28 Appeals, Rectification and Revision

Chapter 29 Collection, Stay of Demand and Recovery

Chapter 30 Refunds

Chapter 31 Settlement Commission

Chapter 32 Tax Audit

Chapter 33 ICDS – Income Computation and Disclosure Standards

Chapter 34 Equalisation Levy

Chapter 35 Tables

(1) Rates of Gold and Silver

(2) List of Bonus Shares Issued

(3) List of Shares FV (Face Value) – Re-structured

(4) List of Right Shares issued

(5) Depreciation Rates as per Companies Act, 1956

(6) Depreciation Rates as per Companies Act, 2013

Chapter 36 TDS from Monthly Taxable Salary for F.Y. 2019-20

Chapter 37 Advance Tax Tables (F.Y. 2019-20) (A.Y. 2020-21)

Chapter 38 Income Tax Tables for Assessment Year 2019-2020

Chapter 39 Advance Tax/Income Tax Calculation by Formula

(1) Advance Tax Calculation (F.Y. 2020-21)

(2) Income Tax Calculation (A.Y. 2019-2020)