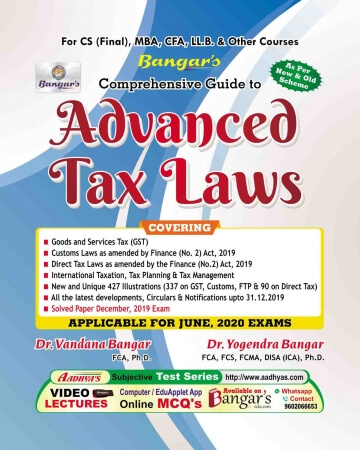

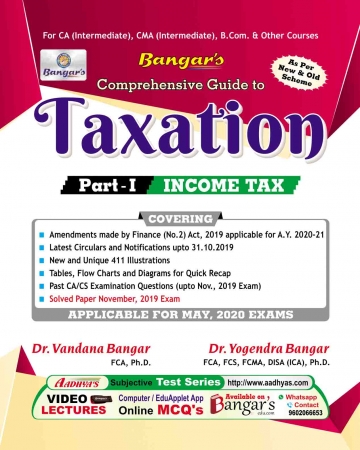

Comprehensive Guide to Advanced Tax Laws and Practice For June 2020 By Dr. Yogendra Bangar and Dr. Vandana Bangar

This Book is useful for cs professional students Appearing in June 2020 Exam

₹1,500

₹1,350

Safe and Secure Payments. Easy returns. 100% Authentic products.

Safe and Secure Payments. Easy returns. 100% Authentic products.

|

HAVE QUERIES? GET QUICK HELP

CHECK CASH ON DELIVERY AND NEXT DAY DELIVERY AT YOUR LOCATION:

- Cash on Delivery

- Next Day Delivery

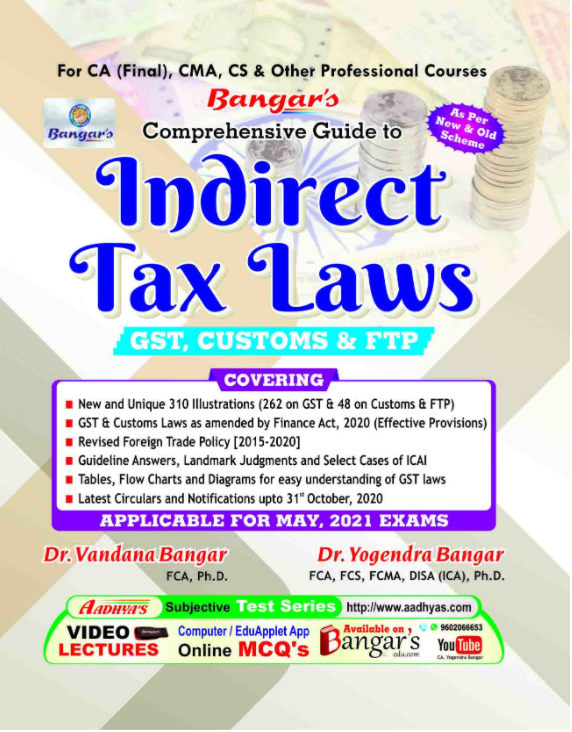

Customers who bought this item also bought:

General Information:

-

Author: Dr. Yogendra Bangar

-

Publication: Aadhya Prakashan

-

Cover: Paperback

-

Language: English

-

ISBN Number: 9788190502764

-

Number of Pages: 950

-

Edition: 15th, 2020

-

Useful For: cs professional

Advance Tax Laws

The distinguishing features of this book are –

Question & Answer Format.

Coverage of all the latest developments in GST including Circulars and Notification upto 31‑12‑2019 including Illustrations on Practical Issues.

Coverage of amendments in Customs Laws by the Finance (No.2) Act, 2019, including latest Circulars, Notifications and Judicial Pronouncements, upto Dec. 31th, 2019.

Coverage of amendments in Direct Taxes by the Finance (No.2) Act, 2019 including latest Circulars, Notifications and Judicial Pronouncements, upto Dec. 31th, 2019.

Coverage of International Taxation, Tax Planning & Tax Management and Practical Problems to illustrate tax planning aspects.

Appendix : Solved Paper - CS Professional Dec. 2019 Exams

SUBJECT INDEX

GST in India - A Brief Introduction

Supply under GST

Charge of GST

Composition Levy

Exemption from GST

Place of Supply

Export and Import

Time of Supply

Value of Supply

Input Tax Credit

Registration

Tax Invoice Credit & Debit Notes and E-Way Bill

Accounts and Records

Payment of Tax, TDS & TCS

Returns

Refunds

Assessment and Audit

Inspection, Search, Seizure and Arrest

Administration, Demands and Recovery

Liability to Pay in Certain Cases

Advance Ruling

Appeals and Revision

Offences and Penalties

Job Work & Miscellaneous Provisions

GST Compensation Cess

Union Territory Goods and Services Tax

CUSTOMS LAW (10 Marks)

Basic Concepts

Classification & Types of Customs Duties

Valuation

Importation and Exportation

Warehousing

Duty Drawback

Baggage, Postal Articles & Stores

Search, Seizure, Confiscation and Miscellaneous Provisions

Exemptions, Recoveries, Demands and Refunds

Appeals and Revision

Advance Rulings and Settlement of Cases

Offences & Prosecution

Foreign Trade Policy (2015-2020)

Foreign Trade Policy (Practical Questions)

Corporate Tax Planning and Tax Mangement

Taxation of Companies

Assessment of Various Other Entities

(FIRM/ LLP/ AOP/ BOI)

General Anti-Avoidance Rules (GAAR)

Transfer Pricing & Other Anti-Avoidance Measures

Tax Treaties

Income Tax Implication on Specified Transactions