Bharat Indirect Taxation By Raj K Agrawal

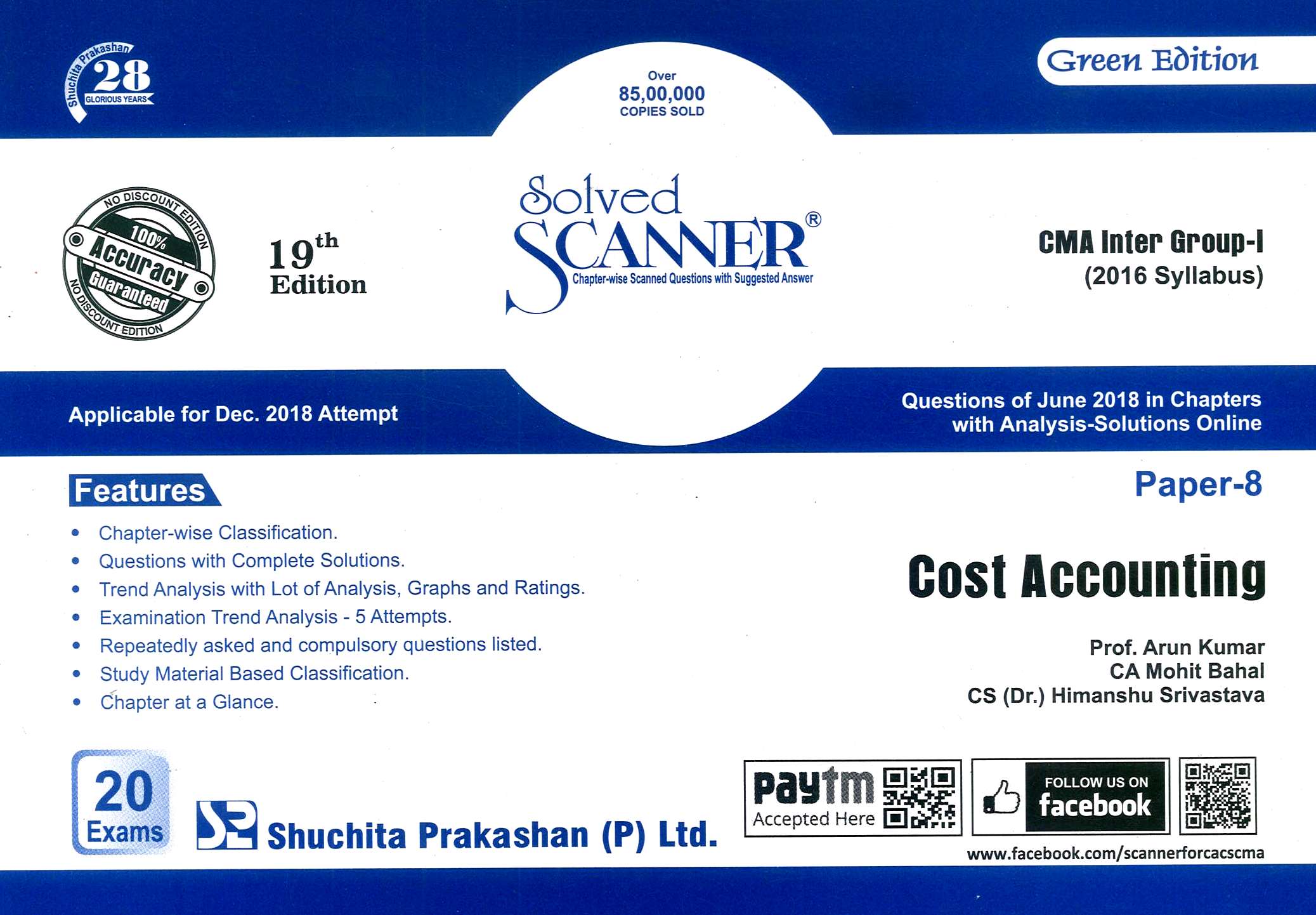

This Book is useful for CMA inter students Appearing in June / Dec. 2018 Exam .

Safe and Secure Payments. Easy returns. 100% Authentic products.

Safe and Secure Payments. Easy returns. 100% Authentic products.

|

- Cash on Delivery

- Next Day Delivery

-

Publication: Bharat

-

Cover: Paperback

-

Language: English

-

ISBN Number: 978-93-5139-584-3

-

Number of Pages: 288

-

Edition: 1st , 2018

-

Useful For: CMA Inter, BBA , B.com

About Indirect Taxation , This Book is useful for CMA inter students Appearing in June 2018 Exam .

Features of the book

- Simple Language

- Chart expressions

- Self-explanatory notes

- Illustrations

- Solved and Unsolved practical problems

Contents -

Chapter 1 Concept of Indirect Taxes

Chapter 2 Introduction to GST

Chapter 3 Levy and Collection of GST

Chapter 4 Concept of supply

Chapter 5 Place of supply

Chapter 6 Time of supply

Chapter 7 Value of supply

Chapter 8 Input Tax Credit

Chapter 9 Computation of GST Liability

Chapter 10 Registration

Chapter 11 Tax Invoice, Credit and Debit Notes

Chapter 12 Electronic Way Bill

Chapter 13 Returns

Chapter 14 Payment of Tax

Chapter 15 Reverse Charge

Chapter 16 Accounts and Records

Chapter 17 Assessment and Audit

Chapter 18 Miscellaneous Provisions

Chapter 19 Introduction to Customs Law

Chapter 20 Types of Duty

Chapter 21 Classification of Imported & Export Goods

Chapter 22 Valuation under Customs

Chapter 23 Import & Export Procedure, Warehousing & Duty Drawback

Chapter 24 Baggage

Chapter 25 Administrative, Refund, Penalties, Seizure