CA Inter Advanced Accounting Text and Problems Group 2 New Syllabus For Nov, 2019 Exam By B.M Agarwal & M.P. Gupta

This Book is useful for CA Inter students Appearing in New syllabus in Nov, 2019 Exam .

Safe and Secure Payments. Easy returns. 100% Authentic products.

Safe and Secure Payments. Easy returns. 100% Authentic products.

|

- Cash on Delivery

- Next Day Delivery

-

Publication: Bharat

-

Cover: Paperback

-

Language: English

-

ISBN Number: 9789351397090

-

Number of Pages: 560

-

Edition: 13th edn., 2019

-

Useful For: CA Inter

About ADVANCED ACCOUNTING (Text and Problems) For CA Inter [Group II (Paper 5)]

Chapter 1 Underwriting of Shares and Debentures

Chapter 2 Accounting for Employee Stock Option Plan and Equity Shares with Differential Rights

Chapter 3 Buy Back of Securities

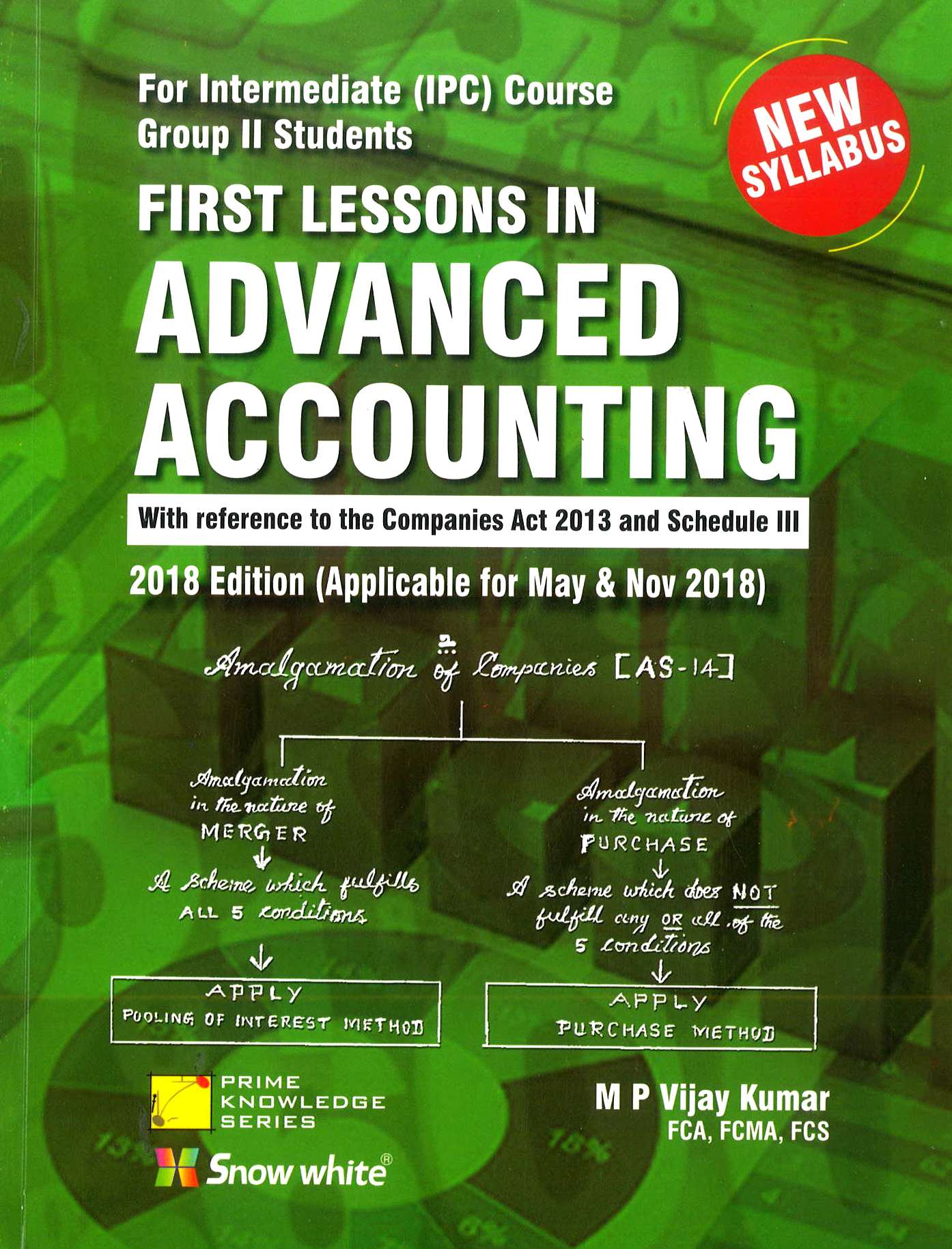

Chapter 4 Accounting for Amalgamation of Companies (Excluding Inter-Company Holding)

Chapter 5 Accounting for Reconstruction of Companies

Chapter 6 Liquidation of Companies

Chapter 7 Financial Reporting of Insurance Companies

Chapter 8 Financial Reporting of Banking Companies

Chapter 9 Non-Banking Finance Companies

Chapter 10 Financial Reporting of Mutual Funds

Chapter 11 Valuation of Goodwill

Chapter 12 Consolidated Financial Statements (With Single Subsidiary)

Chapter 13 Application of Accounting Standards

AS – 7 (Construction Contracts)

AS – 9 (Revenue Recognition)

AS – 14 (Accounting for Amalgamations)

AS – 18 (Related Party Disclosures)

AS – 19 (Leases)

AS – 20 (Earnings Per Share)

AS – 24 (Discounting Operations)

AS – 26 (Intangible Assets)

AS – 29 (Provisions, Contingent Liabilities and Contingent Assets)

Chapter 14 Application of Guidance Note

GN (A) – 5 (Term Used in Financial Statements)

GN (A) – 6 (Accrual Basis of Accounting)

GN (A) – 11 (Accounting for Corporate Dividend Tax) (CDT)

GN (A) – 18 (Accounting for Employee Share-base Payments)

GN (A) – 35 (Accounting for Depreciation in Companies in the context of Schedule II to the Companies Act, 2013)

GN(A) – 22 (Accounting for Credit Available in Respect of Minimum Alternative Tax under the Income-tax Act, 1961)

GN (A) – 23 [Accounting for Real Estate Transactions (revised 2012)]

GN (A) – 29 (Turnover in Case of Contractors)

Schedule III to the Companies Act, 2013

About the Author

Dr. B.M. Agarwal

He is ex-head of the Department of Commerce, DA V College, Kanpur. He has been guiding students of CA, CS & CMA (CWA) for more than 45 years. He has been visiting faculty member at the Northern India Regional Council of the Institute of Chartered Accountants of India and at Kanpur Chapter of the Institute of . Company Secretaries of India

Dr. M.P. Gupta

He is at present Director of Jagran College, Kanpur. He has been former Head, Deptt. of Commerce, VSSD College, Kanpur and Ex. Dean, Faculty of Commerce, CSJM, Kanpur University. He has been visiting faculty member at the Northern India Regional Council of the Institute of Chartered Accountants of India and at Kanpur Chapter of the Institute of Company Secretaries of India. He has experience of guiding students of Professional Courses of CA, CS and CMA (CWA) for more than 45 years